ZUGFeRD 2.4 export / Factur-X 1.08 for Dynamics 365 FO

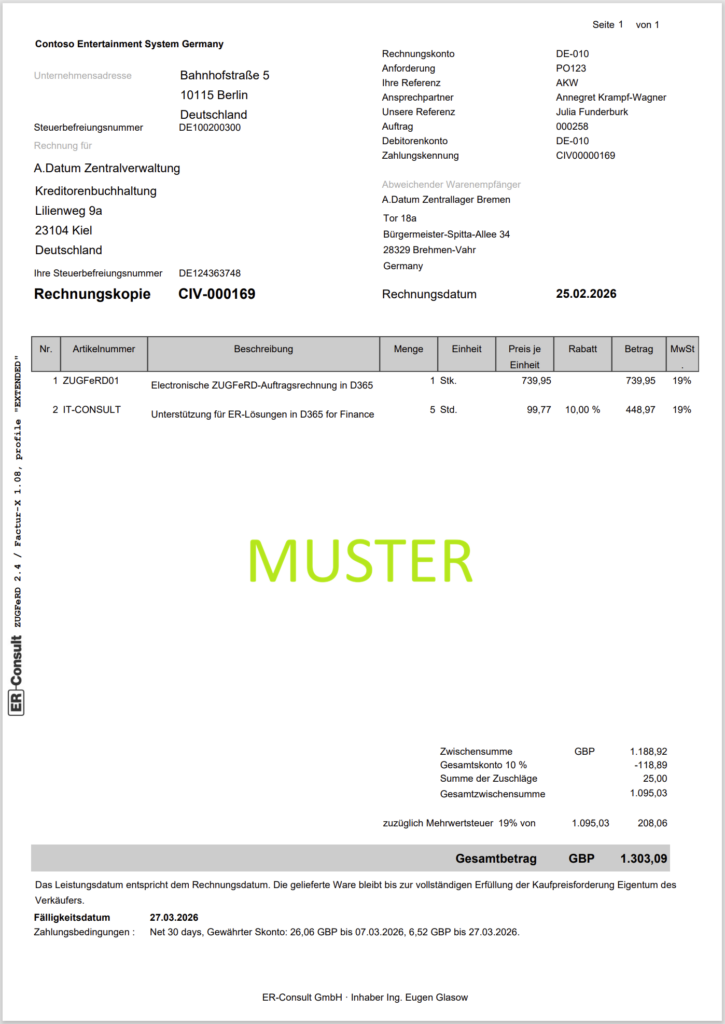

We are excited to announce the release of the common German-French electronic invoice ZUGFeRD / Factur-X in Dynamics 365 for Finance and SCM. This plug-and-play solution in its “Light” version does not require any customisation and can be easily installed in the standard Electronic Reporting module of D365. It supports the ZUGFeRD 2.2-2.4 / Factur-X 1.07-1.08 profile EN 16931, also known as the “COMFORT” profile, but also “BASIC”, “XRECHNUNG” and the “EXTENDED” profiles. All profiles except the “BASIC” meet the tax law requirements and must be accepted by customers unless explicitly denied.

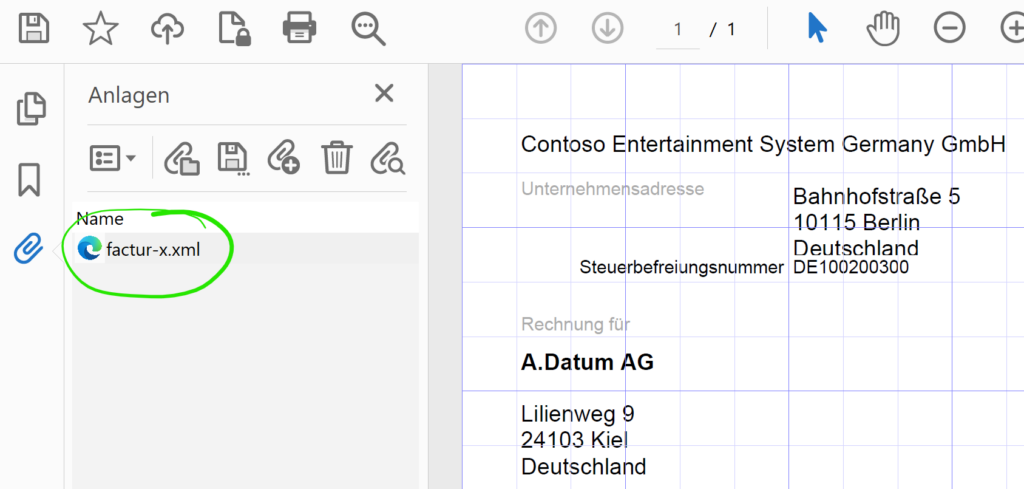

In the ZUGFeRD/Factur-X standard, the invoicing information is included in an XML payload attached to a human-readable PDF file (see https://de.wikipedia.org/wiki/ZUGFeRD). This is in contrast to the Italian electronic invoicing system, where a PDF is embedded in a Base64 encoded block within an XML. The PDF document is just a visualisation of the electronic content, what counts is the XML attachment. The XML file is always named factur-x.xml and it is attached to at the PDF document level, not to a single PDF page:

Here is an example: factur-x.xml

Our solution, which utilizes Configurable business documents in D365, supports Sales invoices with separate buyer, seller, and order accounts, as well as the Free text invoice. Other types of invoices such as the Project invoices, can be provided upon request at a discounted price. Our solution also handles form notes, line and header notes and footers, line discounts, total discounts, and cash discounts, document level and line level charges, properly reflecting VAT for domestic, EU, and export sales. The settlement instructions orchestrate a SEPA credit transfer or a SEPA direct debit withdrawal; partially prepaid invoices are properly interpreted.

In addition, the EXTENDED profile introduces structured cash discounts, HS (customs Harmonized System = Intrastat) codes, countries of origin, standardised VATEX exemption codes, and more. To ensure backward compatibility and in response to customer requests, support for the BASIC and XRECHNUNG profiles has also been added.

The solution is available in French, German, British and American English, Spanish. The PDF itself may be rendered in German, French, British and American English, Spanish and Dutch.

Price

| Version | Price | Deliverables | Notes |

| Light | €890 | A ZUGFeRD Sales invoice ER configuration, the XML file only | This option does not require any X++ customisations or 3rd party software and can be installed and used right away. |

| Light+ | €1200 | Same as the Light version but with 5 hours of prepaid consulting and installation | |

| Heavy | €2200 | Contains the full solution, including a PDF template, and a PDF post-processor with 8 hours of prepaid consulting and installation. | Includes the iText 7.2.6 library for .NET 4.6.1 under the GNU Affero General Public License v3 Includes the BouncyCastle 1.9.0 cryptographic library for .NET 4.0 under a MIT license. |

You may acquire the solution on the official Microsoft App Source portal: https://appsource.microsoft.com/en-us/product/dynamics-365-for-operations/er-consultgmbh1674479095356.zugferd_light_plus

Setup and use

Basic setup: “Light” and “Heavy”

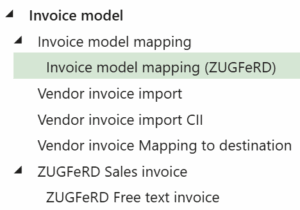

- For the ease of installation, configuration and integration, the standard Invoice model v 277 and the standard Invoice model mapping are used (the recent mapping is 277.273 as of 31.03.2025 ),

make sure they have been imported upfront. Any other versions of the Invoice model may co-exist, but the 277th must be present.

make sure they have been imported upfront. Any other versions of the Invoice model may co-exist, but the 277th must be present. - Import the Electronic configuration “ZUGFeRD Sales invoice” provided to you (Organisation administration > Electronic reporting > Configurations, button Exchange / Load from XML file). Optionally, import the custom Invoice model mapping (ZUGFeRD), see below, and the “ZUGFeRD Free text invoice“. If you decided to use the Invoice model mapping (ZUGFeRD), it must be marked Default for model mapping.

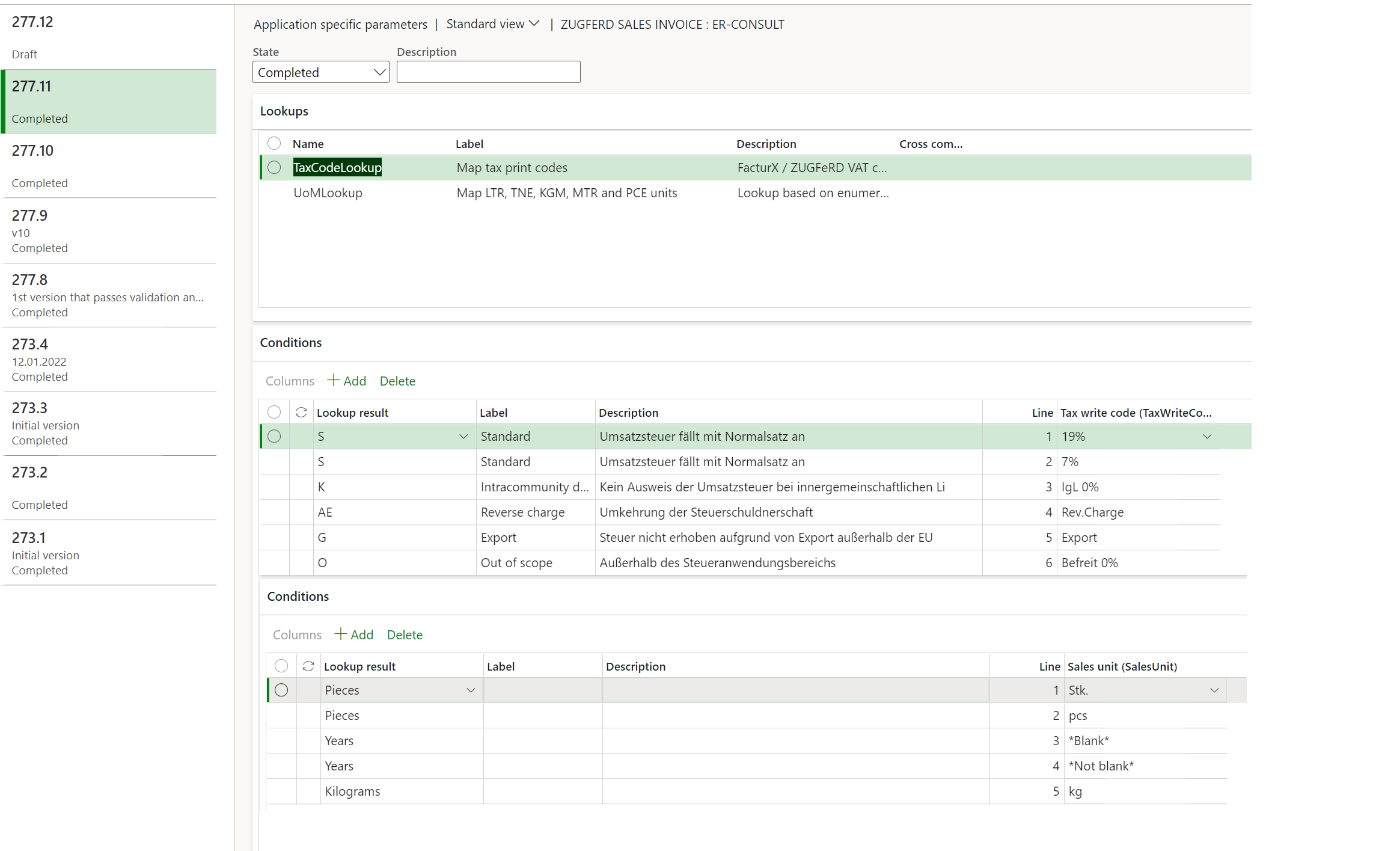

- Under the button Configurations / Application specific parameters / Setup, provide a mapping of the VAT (en-us: Sales tax) Print codes to the ZUGFeRD categories S, K, AE, G, O (for example, the 19% and 7% VAT belong to the “S” category). Also provide a mapping of the D365 Unit of measure codes to the UNECE Recommendation No. 20 list called “Codes for Units of Measure Used in International Trade” (see Codes for Units of Measure used in International Trade: Recommendation N°.20 – Revision 7 | UNECE). For instance, a piece has the standard code H87. A sample parameter setup can be downloaded here: 03-01-2023 03.29.45 pm_ZUGFeRD Sales invoice.277.11 Once both the mappings have been established, set the Application specific parameters State to Completed.

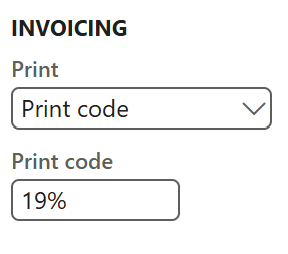

Pay attention to the sample VAT print codes on the screenshot above: the standard Invoice model mapping does not pass the tax rates to the report, and the VAT Print code must contain the VAT rate in numbers, if applicable. In other words, they should look like “19%” and “7%” in Germany or “20%” and “5,5%” in France. In addition, the parameter Invoicing / Print at the VAT groups (en-us: Sales tax groups) must be set to VAT codes (en-us: Sales tax codes). Hint: only the VAT payable codes are relevant (de: “Umsatzsteuer“, not “Vorsteuer“).

Pay attention to the sample VAT print codes on the screenshot above: the standard Invoice model mapping does not pass the tax rates to the report, and the VAT Print code must contain the VAT rate in numbers, if applicable. In other words, they should look like “19%” and “7%” in Germany or “20%” and “5,5%” in France. In addition, the parameter Invoicing / Print at the VAT groups (en-us: Sales tax groups) must be set to VAT codes (en-us: Sales tax codes). Hint: only the VAT payable codes are relevant (de: “Umsatzsteuer“, not “Vorsteuer“).

The current Microsoft Invoice model mapping Sales invoice does not pass the EU Tax directives into the report. By default, the report relies on the non-EU Tax exempt codes in the same way as the standard Excel invoice does. The provided Invoice model mapping (ZUGFeRD) changes that and makes the Tax directives available. Should there be both a Tax directive and an Exemption code in your VAT setup, the Exemption code wins and it will be shown in the tag

<ram:ApplicableTradeTax></ram:ApplicableTradeTax>...<ram:ExemptionReason>Tax-free EC shipments with tax registration number</ram:ExemptionReason>...

- The mapping of the sales units of measure is against the language-specific, translated unit texts (if exists), not the UoM symbol used in D365 globally, i.e. not pcs but Stk. You may find them in the Organization administration > Setup > Units form, button Unit texts. This Stk. then becomes H87 in the output file. The configuration translates the local units of measure to one of the H87, KGM, MTR, LTR, TNE, CMT, HUR, DAY, GRM, MIN, MON, WEE, MMT, SEC, C26, YRD, APZ, FOT, GLL, INH, ONZ, LBT.

The Years class is used as a fallback: no translation is applied and the unit text falls through as it is; for example, a UN mapped to Years remans UN in the output file.

To perform some post-processing, translate one unit to many as 1:N (for example, the unit ea may be translated to either C62 - an abstract units of service - or pieces H87 depending on the context), you may derive your own format version from the ZUGFeRD Sales invoice and extend the formula model.InvoiceLines.$SalesUnit2UN in the format Mapping.

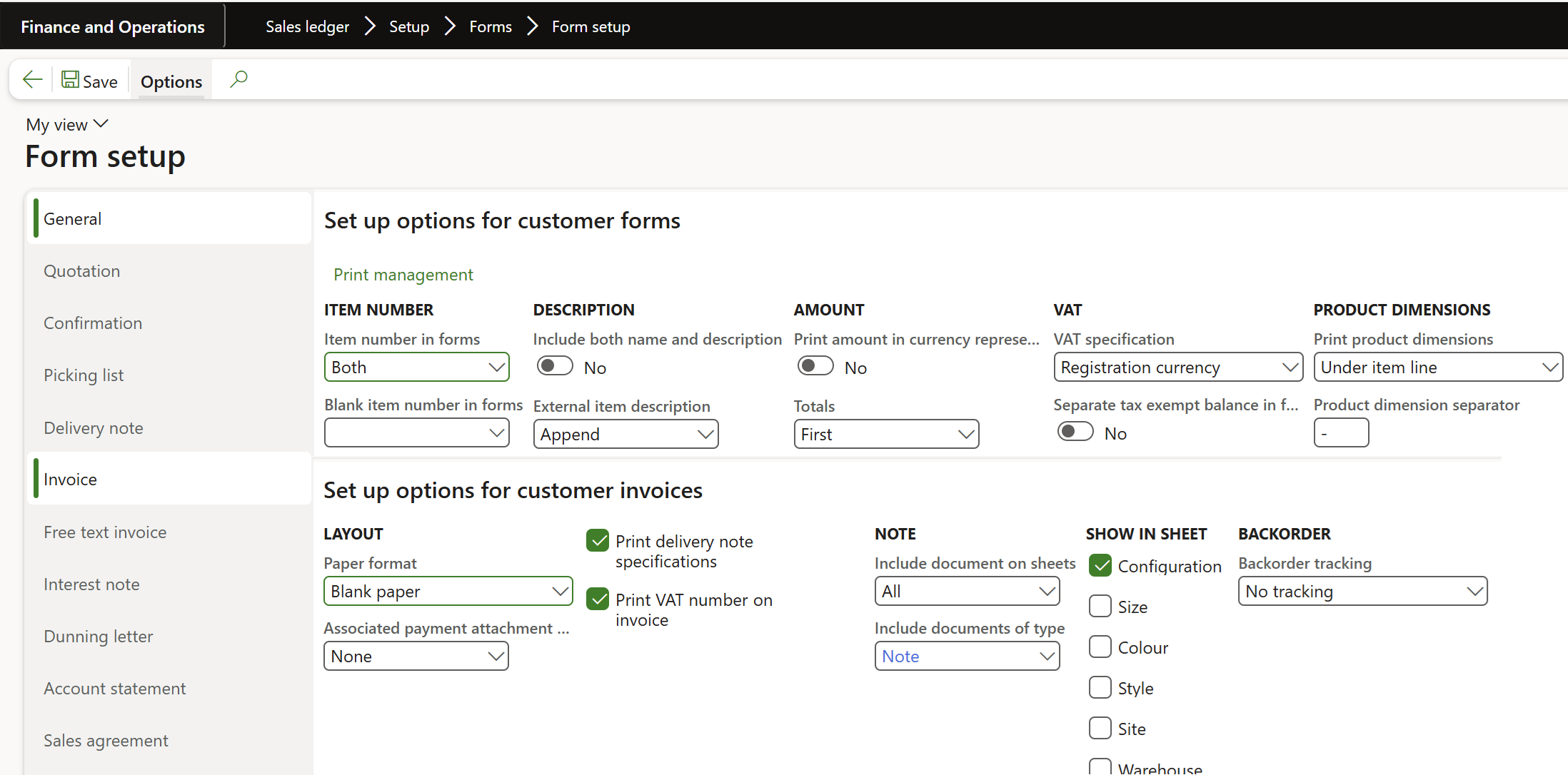

- Open Sales ledger (en-us: Accounts receivable) > Setup > Forms > Form setup. Make sure that the VAT specification option is set to Registration currency. Other parameters are not critical and only affect the visualisation in PDF; for example, you may wish to display external item numbers: Item number in forms = Both.

- On the Invoice and Free text invoice tabs, make sure the option Print VAT number on invoice is ON: it is mandatory. The option Print delivery note specifications should be better set, too: it populates the <ActualDeliverySupplyChainEvent> and the <DeliveryNoteReferencedDocument> tags. The Include documents… parameters activate the display of line and header notes.

Show in sheet: Configuration, Size etc. activates the line inventory dimensions, where the [translated] name becomes the Description and the code becomes the Value of an ApplicableProductCharacteristic:

<ram:ApplicableProductCharacteristic><ram:Description>Size</ram:Description><ram:Value>1440</ram:Value></ram:ApplicableProductCharacteristic>

To fix that, an X++ extension of the SalesInvoiceDP class is required, or serious adaptation of the ER report (see the useful link to a Docentric article below). However, the active Retail Call Center ("MCR") configuration key (it is usually active) may help avoid customisations: their MCRMarkupCalculatedAmount field keeps the total of all line charges which affect the invoice amount. This MCRMarkupCalculatedAmount is leveraged in our ZUGFeRD configuration to reflect the sum of all charges per line:

In accordance with the ZUGFeRD specification, this markup amount increases the total line amount before VAT <ram:LineTotalAmount/>, and it is excluded from the header level charges <ram:ApplicableHeaderTradeSettlement>.<ram:SpecifiedTradeAllowanceCharge>.

- Finally, open Print management and select the Report format = ZUGFeRD Sales invoice at the Customer invoice node. Specify a Footer, too. Repeat it for the the ZUGFeRD Free text invoice, if needed. Use conditional print management settings of only a subset of customers wishes to receive the ZUGFeRD invoice (check a guidance below among the “Useful links”).

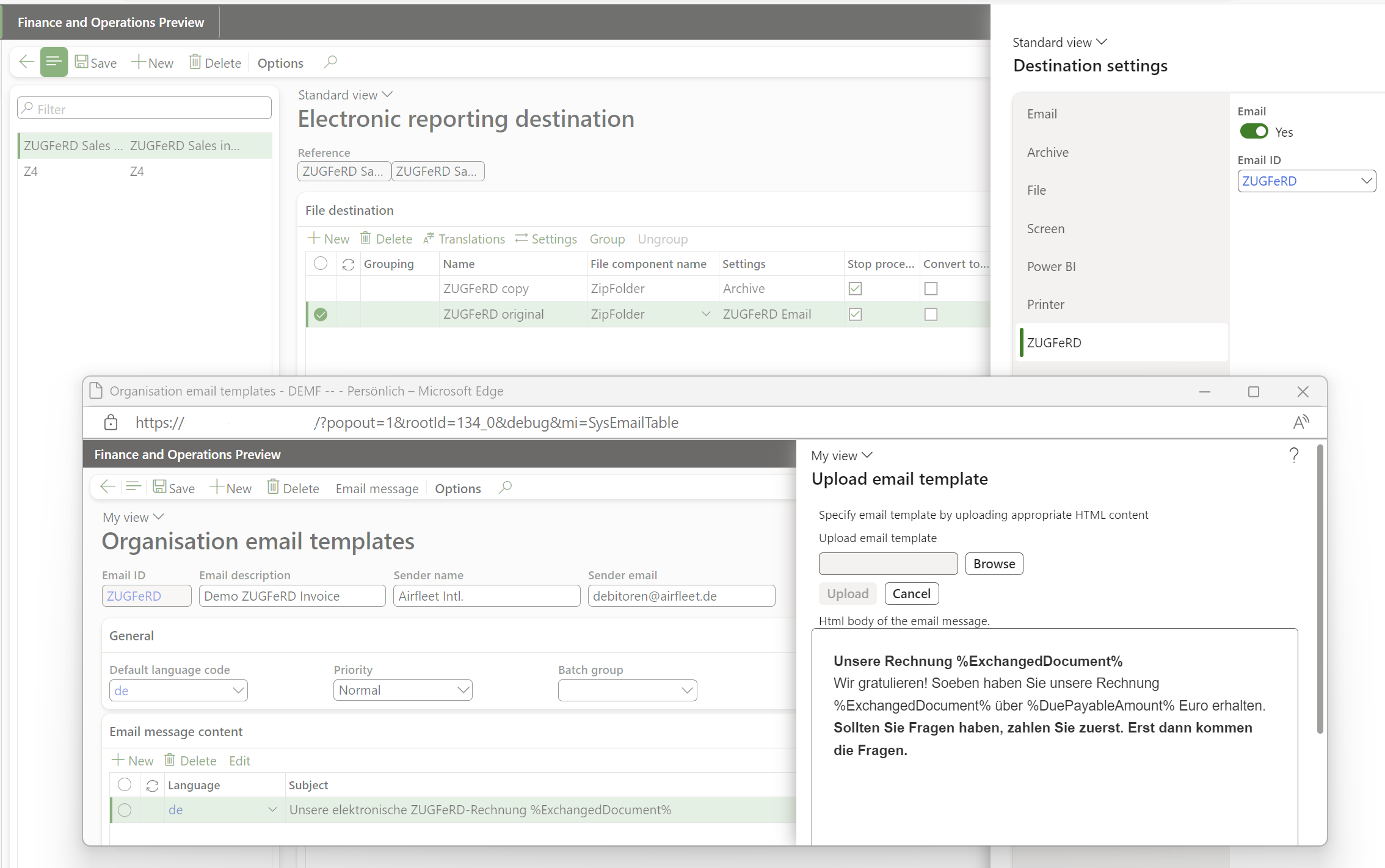

- Create a new ER destination (Organisation administration > Electronic reporting > Electronic reporting destination) for the report ZUGFeRD Sales invoice, and the ZUGFeRD Free text invoice if needed. Under File destination, add a new line, choose the factur-x file component and divert it to a destination of your choice (for instance, the Screen).

Supplementary setup: “Heavy”

- For the Heavy version, first deploy the X++ customisations and libraries from the D365 deployable package provided to you.

- Create a new File document type in the Organisation administration > Document management > Document types list. Enter the Name of the document type exactly like this: ZUGFeRD.

- In the ER destination (see 9 above) this time choose the ZipFolder file component. Click Settings, divert the file to the Archive: set it to Enabled on the respective tab and choose file Type = ZUGFeRD from step 11. The hybrid invoice may either be shown on the Screen, or attached to the Electronic reporting job log, or dropped as an attachment to the Customer invoice journal. This option “Attach ZUGFeRD to” is selected on the Attachments tab in the Electronic reporting parameters (see the Electronic reporting workspace, the button Electronic reporting parameters at the very bottom):

- To send the invoice per Email, add a new file destination line, click Settings, open the tab ZUGFeRD, and flip the Email slider. In the Email ID parameter, you may also select an Organisation administration > Setup > Organisation email template with an appropriate subject and a HTML body in your corporate design. You may download and use our elegant templates: ZUGFeRD_emailTemplate_EN, ZUGFeRD_emailTemplate_DE. Placeholders %ExchangedDocument% (invoice ID), %DuePayableAmount% (invoice amount) and %BuyerTradeParty% (customer ID) are supported out of the box i.e., the email subject and body of the email are dynamic. The selection Document type in this ER destination must remain Any or Electronic.

- The steps to configure the Heavy version end here. The Electronic Reporting engine will fill out the PDF form, populate an XML file and put both into a folder (i.e. a ZIP). This ZIP file is intercepted, unpacked, and the XML part is embedded into the PDF, adding some references and mandatory attributes. The PDF file is PDF/A-3B compliant, it can be read and parsed, it passes the validations (see the links below).

- Print the sales invoice with the option Use print management turned on. The resulting PDF document is rendered on the screen (the Light version offers an XML file to download) and/or sent to the customer’s email address with the role Invoice. In the batch invoicing mode (de: “Autofaktura”), choose an Attachment option instead of the Screen in the Electronic reporting parameters.

- You may also re-print invoices out of the Invoice journal form (Sales ledger > Enquiries and reports > Invoices > …) with the button View.

An example of a ZUGFeRD invoice with the COMFORT profile may be found here: ZUGFeRD_COMFORT.pdf

Custom Mapping and the EXTENDED profile

The EXTENDED profile, compared to the ‘EN16932’ profile (also known as the ‘COMFORT’ profile), adds the following elements

- Structured payment terms, such as cash discounts in %;

- Serial numbers, batch numbers per line (not present on a Free text invoice a.k.a. “FTI”);

- Delivery note numbers and dates per line (not present on a FTI);

- Customer’s PO reference per line;

- Ship to party (a deviating shipping address, see below);

- Package quantity (per line only, not present on a FTI);

- Delivery terms with the destination country and the “place” (for DAP and similar INCOTERMS, where the place is taken from the field Reason for export at the sales invoice header);

- <ExemptionReasonCode> i.e., the reason for exemption from VAT obligation provided as a CEF VATEX code.

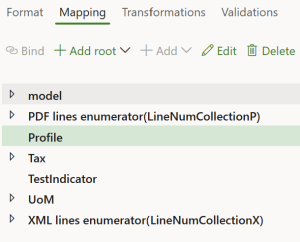

In the Root of the ZUGFeRD Sales invoice format mapping, a variable “Profile” is introduced. It acts as a profile selector. By default, it returns the number “3” for the COMFORT (=EN 16931) profile. The values “2”, “3”, “4” and “5” are reserved for the profiles BASIC, EN 16931, XRECHNUNG, and EXTENDED, respectively.

In the Root of the ZUGFeRD Sales invoice format mapping, a variable “Profile” is introduced. It acts as a profile selector. By default, it returns the number “3” for the COMFORT (=EN 16931) profile. The values “2”, “3”, “4” and “5” are reserved for the profiles BASIC, EN 16931, XRECHNUNG, and EXTENDED, respectively.

For example, to switch to the EXTENDED profile, derive your own version of the format, open the format Designer, select the Profile node to the right on the Mapping tab, click Edit and let the formula return “5”. Through a derived mapping, this variable may be even tied to a property of the customer (some CustTable field) to act as a dynamic selector of the profile.

Similarly, to enable test mode, set the TestIndicator variable to true. This will insert the <ram:TestIndicator> tag into the XML, which is essential when validating transmission channels with buyers. N.B.: The TestIndicator is only allowed within the EXTENDED profile.

For the EXTENDED profile to function, the custom Invoice model mapping (ZUGFeRD) is necessary. The same custom mapping enables some features of the COMFORT and XRECHNUNG profiles, for example the country of origin or the HS code, or the city name. For the reasons of compatibility, these features – even though they belong to the COMFORT profile – are unlocked by the Profile > 3, too.

Below are additional steps to get the most of the EXTENDED profile:

- Deploy the Electronic configuration “Invoice model mapping (ZUGFeRD)” (Organisation administration > Electronic reporting > Configurations, button Exchange / Load from XML file).

- Select it in the ER tree, and make it Default for model mapping to resolve the ambiguity between the custom and the standard Invoice model mapping.

- To embed HS codes and the country of origin into the <DesignatedProductClassification> tag, make sure the Commodity code and the Country/region are populated at Product information management > Products > Released products.

- For the batch and serial numbers to appear in the <IndividualTradeProductInstance> node, mark Show in sheet: Batch number and/or Serial number on the Invoice tab in the Form setup form (see the screenshot in the previous section).

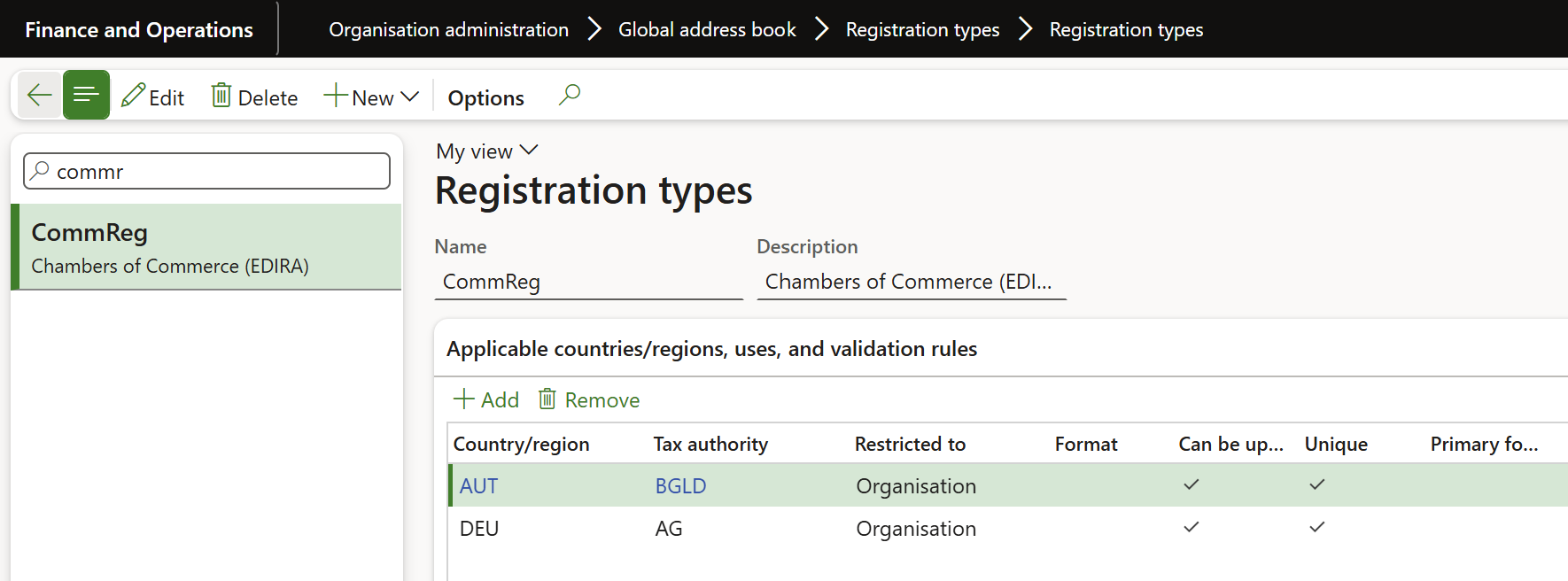

- For the output of the commercial register (de: Handelsregister or HRB) number, a dedicated Registration type must be given the Czech (!) category “Spisova znacka” under Organization administration > Global address book > Registration types > Registration categories (this is how the standard free text invoice works):

<ram:IncludedNote>

<ram:Content>Landesgericht Eisenstadt 533252 w</ram:Content>

<ram:SubjectCode>REG</ram:SubjectCode>

</ram:IncludedNote>

- Before leaving the Organisation administration > Organisations > Legal entities form, check if the company Bank account is populated, and this bank account has an IBAN and a SWIFT code (the selection of alternative bank accounts nominated in foreign currencies may be implemented via the Modes of payment).

Useful links

- End user license agreement: ZUGFeRD_Heavy_EULA

- End user license agreement: ZUGFeRD_ExportLight_EULA

- The French PDF / XML validator is available online on Factur-X Validator (fnfe-mpe.org)

- The German validators are now hosted at portinvoice | Safe Harbour für eingehende E-Rechnungen

- A rich interactive ZUGFeRD schema navigator is hosted here: EN 16931 – FacturX 1.03 – ZUGFeRD 2.0.1 – COMFORT (gefeg.com), for the German dialect refer to XRechnung_CII; v1.2.1; 28.06.2019

- Docentric: Add Charges to Sales Invoice Lines through ER

- Docentric about conditional print management settings: Print Management for the Curious

Extensibility

Please bear in mind that PDF forms do not contain dynamic, repeatable ranges or cells (refer to Filling PDF Forms with Electronic Reporting in Dynamics 365 for Finance for more details). This is the reason why the number of invoice lines is limited by the PDF template; change the constants Paginator.#LinesMax, #LinesOnFirstPage and #LinesOnNextPages in accordance with the template to let Dynamics control the number of pages.

The “output actions” i.e. different transmission options are extendable; new output actions may be offered upon request at a discounted price. You may even add your own class ERFileOutputActionXXX_ZUGFeRD. If inherited from the ERFileOutputActionPersist_ZUGFeRD, it will commit the synchronous transmission, setting the SentElectronically flag at the invoice in the process. The interface ERIDocuManagementAttachable_ZUGFeRD interacts with the Archive electronic reporting destination, replacing the file to attach to the ER job record.

The method sendFile() must be implemented. It receives a memory stream with the hybrid invoice and transmits it to the final destination.

The method makeVisitor() must be implemented, too. Its result – a ERFileOutputActionXmlVisitor object – subscribes to the post-processor to extract information from the XML. By default, it receives the file name of the PDF. The input parameter of the method andVisitNode() is the name of a tag in the CII invoice (without the “ram” or “rsm” schema prefix). For example, if instantiated with return visitor.andVisitNode(“ExchangedDocument”), the Visitor object will also receive the invoice number.

/// <summary>

/// Send the resulting PDF to a browser window interactively

/// </summary>

[ERFileOutputAttribute_ZUGFeRD(SRSPrintMediumType::Screen)]

class ERFileOutputActionScreen_ZUGFeRD extends ERFileOutputAction_ZUGFeRD

{

ERFileOutputActionXmlVisitor_ZUGFeRD visitor;

/// <summary>

/// The screen destination does not need to extract any contact info

/// </summary>

/// <returns>An empty visitor class</returns>

public ERFileOutputActionXmlVisitor_ZUGFeRD makeVisitor()

{

visitor = new ERFileOutputActionXmlVisitor_ZUGFeRD();

return visitor;

}

/// <summary>

/// Display the PDF file formed by ERFileDestinationPostProcessor_ZUGFeRD on the screen

/// </summary>

/// <param name = "_outputPDF">Stream with a PDF file, with a CII XML attached</param>

/// <returns>Success or failure to display</returns>

public boolean sendFile(System.IO.MemoryStream _outputPDF)

{

Browser br = new Browser();

str downloadUrl = File::SendFileToTempStore(_outputPDF,

ERConstants_ZUGFeRD::ZUGFeRD_Filename,

classstr(FileUploadTemporaryStorageStrategy),

true);

if (downloadUrl != '')

{

br.navigate(downloadUrl, true, false);

}

else

{

return checkFailed("@ApplicationPlatform:DownloadFailed");

}

return true;

}

}

E-invoice and configurable business documents blog series

Further reading:

ZUGFeRD 2.3.x export/ Factur-X 1.07.x for Dynamics 365 FO

ZUGFeRD 2.3.x import for Dynamics 365 for Finance

Filling PDF Forms with Electronic Reporting in Dynamics 365 for Finance

Aktueller Stand der eRechnung in D365 for Finance (Deutschland)

Austrian Peppol-UBL e-invoice

How NOT to send an order confirmation per e-mail

Enumerate lines in Configurable Business Documents

Canvas sections in D365 Configurable Business Documents

Italian eInvoicing FatturaPA, CIG and CUP numbers, RIBA

Italian eInvoicing FatturaPA: Part 2