EU Tax directives

A well-formed intra-community or export invoice in the European Union should have a certain remark for the issuer (exporter) to have a tax-free delivery, and for the recipient (importer) to apply the proper tax regime.

In the past we used to build complex hard-coded logic into our invoices in Dynamics AX: “if the destination delivery address is not our country but another EU member, and the goods are tangible, then print XXXX, otherwise YYYY” etc. It turns out we were reinventing the wheel. Pascal, a colleague of mine, discovered a function called Tax directive which emerged apparently in one of the AX2012 releases and remained in Dynamics 365 for Finance and Operations EE.

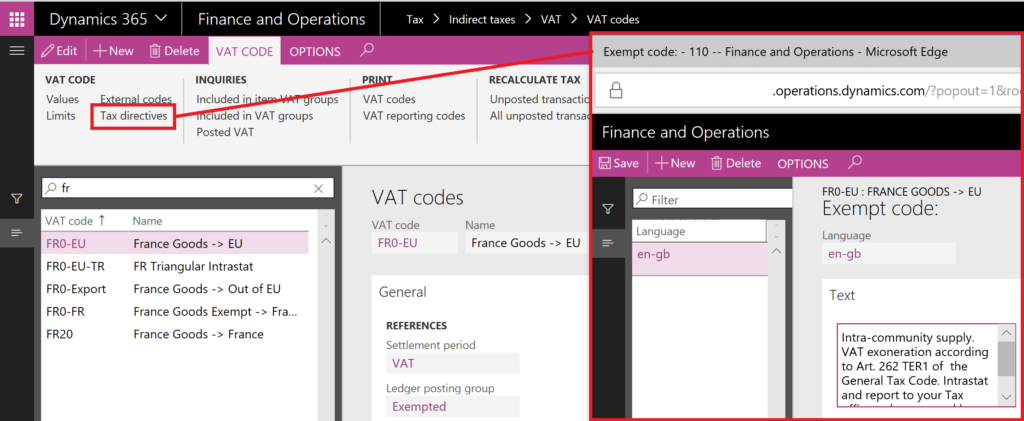

On the VAT codes screen there is a button called Tax directives. This button appears in legal entities with a primary address in one of the EU countries. The remark can be entered in the language of the prospective customer:

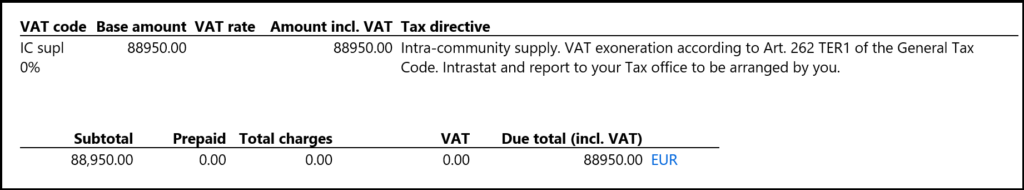

Now, if the parameter VAT specification in Sales ledger (en-us: Accounts receivable) > Setup > Forms > Form setup is set to either Registration currency or Registration and company currency, the text of the directive appears nicely in the middle section of the sales order invoice or the free text invoice:

The remarks are as flexible as the tax configuration itself, and the tax directives are additive, which allows for complex cases e.g. where services (=reverse charge) and goods (=IC delivery) are billed with one invoice.

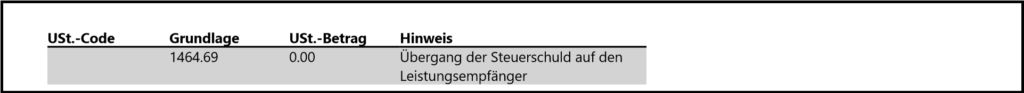

There are limitations. The tax directives are not yet available on PSA (professional service automation) project invoices, in particular on the so-called “Project invoice without billing rules”. The remedy is the VAT exempt codes with their Translations. They are a bit more difficult to configure because not assigned to tax codes directly but to VAT group — Tax code combinations, but they fulfil the same purpose, here for the reverse charge remark in the German language:

You may vote for my product improvement suggestion to extend the VAT directives into the Project accounting realm sooner.

Blog series on Finance and VAT in the EU

Further reading:

Luxembourg VAT Declaration for D365FO in PDF

Troubleshoot the VAT Declaration in D365 for Finance

D365 Petty cash review

Advance payment invoices in Fixed fee projects in D365, D-A-CH style

Sometimes you pay Reverse Charge in D365

Minimalistic EU VAT Configuration in Dynamics 365

Austrian VAT declaration / Umsatzsteuervoranmeldung 2020

EU Tax directives