German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

Travel expense reporting in Germany may be implemented in Dynamics 365 for Finance with literally no customizations. A special attention must be paid to the per diem calculation.

Introduction

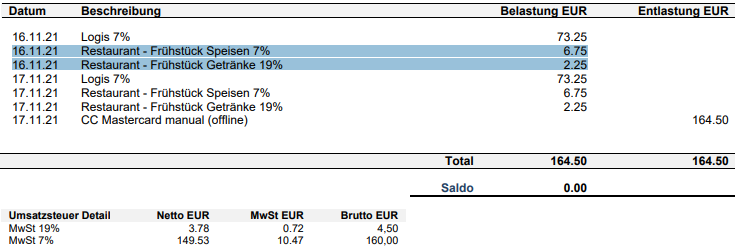

In general, per diem in Germany is an allowance for catering. Hotel bills are reimbursed in full. An employee of a German company – let’s call her Erika Mustermann – typically gets reimbursed for meals a fixed statutory amount per day. If she is paid above the legally prescribed daily rate, the difference would be subject to her income tax.

For domestic trips within Germany she becomes 28 Euro per day, yet this full rate is only applied from the second day on multi-day business trips. For the first and the last day Erika becomes only ½ of the daily ration = €14:

| Length of the trip | Per diems rate 2020-2022 |

|---|---|

| Less than 8 hours | 0 EUR |

| More than 8, less than 24 hours | 14 EUR |

| 24 hours (a full calendar day) | 28 EUR |

| First day (arrival) or last day (departure) | 14 EUR |

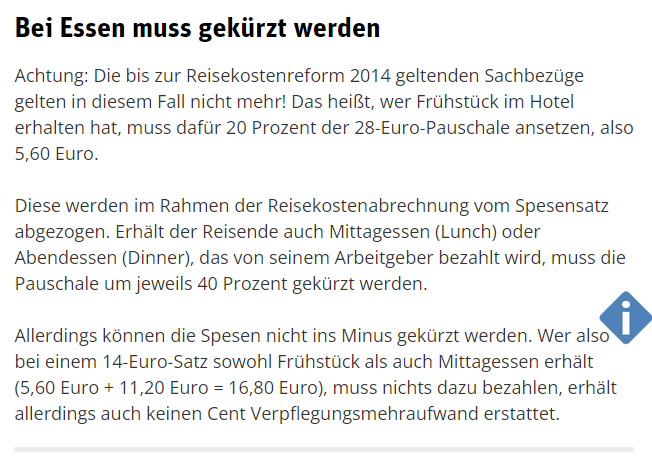

Erika is obliged to report every free meal sponsored by the employer or customer, reduce the daily allowance in accordance with the “20-40-40” rule:

| Meal type | Reduction | Reduction amount |

|---|---|---|

| “Free” breakfast at the hotel | 20% | -€5,60 |

| Free lunch at work | 40% | -€11,20 |

| Dinner sponsored by the boss | 40% | -€11,20 |

The statutory per diem rates vary by country and sometimes specific to a city. The rates are regularly updated by the federal government and rounded to full euros: https://factorialhr.de/blog/verpflegungspauschale-2022/. The “20-40-40” meal reduction rule also applies to destinations abroad, based on the full 24h rate.

In the following chapters 4 distinct realistic cases are explored, with the appropriate setup in Dynamics 365 for Finance:

Domestic business travel – Case 1 “One-day training”

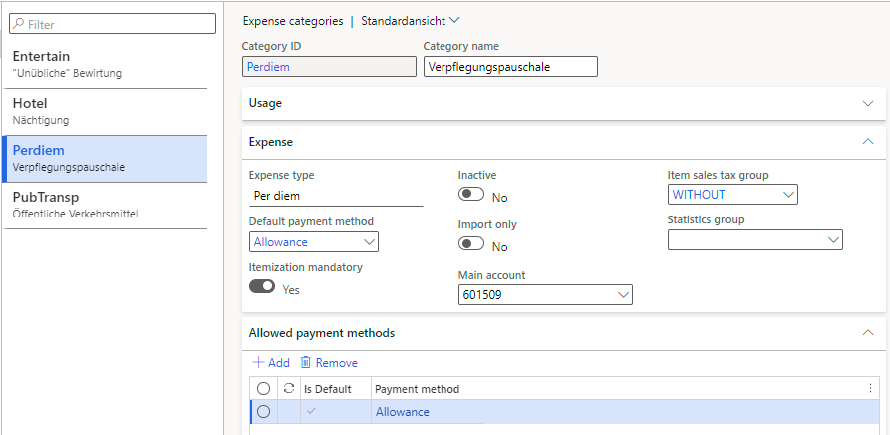

Let’s start setting up the system for the Case 1. First of all, we require a shared expense category PerDiem of the type “Allowance”. This expense category is then selected under local legal entity expense categories (Expense management > Setup > General > Expense categories). In Germany the allowance excludes tax, i.e. the VAT may not be claimed:

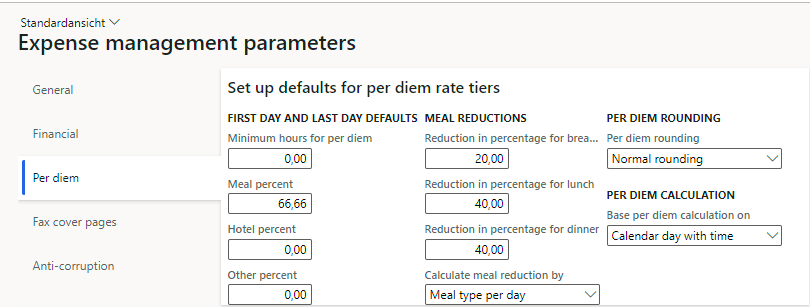

The right per diem parameters (Expense management > Setup > General > Expense management parameters) for Germany can be read from the following screenshot:

In our second case the allowance is paid for every of the 3 calendar days and the Base per diem calculation on must be Calendar day with time. The Meal reductions are self-explaining. The First and last day defaults are used to model the reduced rate on the days of arrival and departure. The Per diem rounding = Normal rounding, because we don’t round up cents to whole euros.

The Calculate meal reduction by may be set to either Meal type per day and Meal type per trip, since the breakfast weights less than lunch/dinner and the meal reduction amount stays the same for the first/last/middle day.

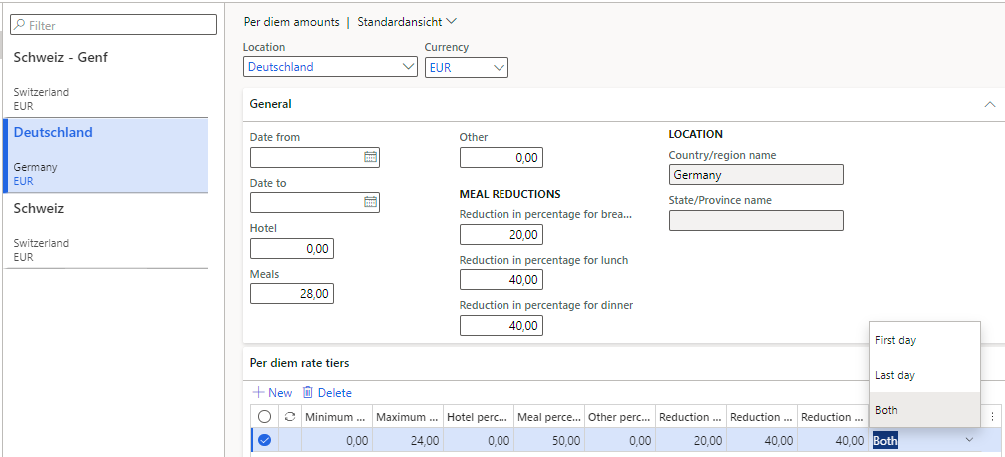

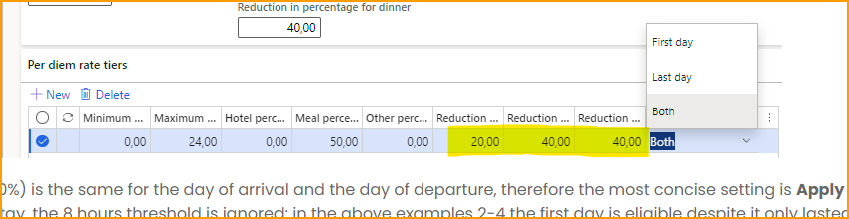

Per diems locations shall be created next. Every leg in on the business trip has to be given a “location” to deduct the right allowance for that country or city. The rate per location is assigned here: Expense management> Setup > Calculations and codes > Per diems. The fist and the last day assume a reduced allowance, this can be modelled by means of the Per diem rate tiers:

The reduction (€14/€28 = 50%) is the same for the day of arrival and the day of departure, therefore the most concise setting is Apply to = Both. On an overnight stay, the 8 hours threshold is ignored: in the above examples 2-4 the first day is eligible despite it only lasted 24:00-18:00 = 6 hours. Therefore we may not set Minimum hours = 8; the threshold can be enforced differently with a customized “Expense report policy”, see below.

We now can test Case 1, but first make sure that the Meal reduction, Breakfast, Lunch, Dinner, Location fields are activated in the Expense management > Setup > General > Display fields.

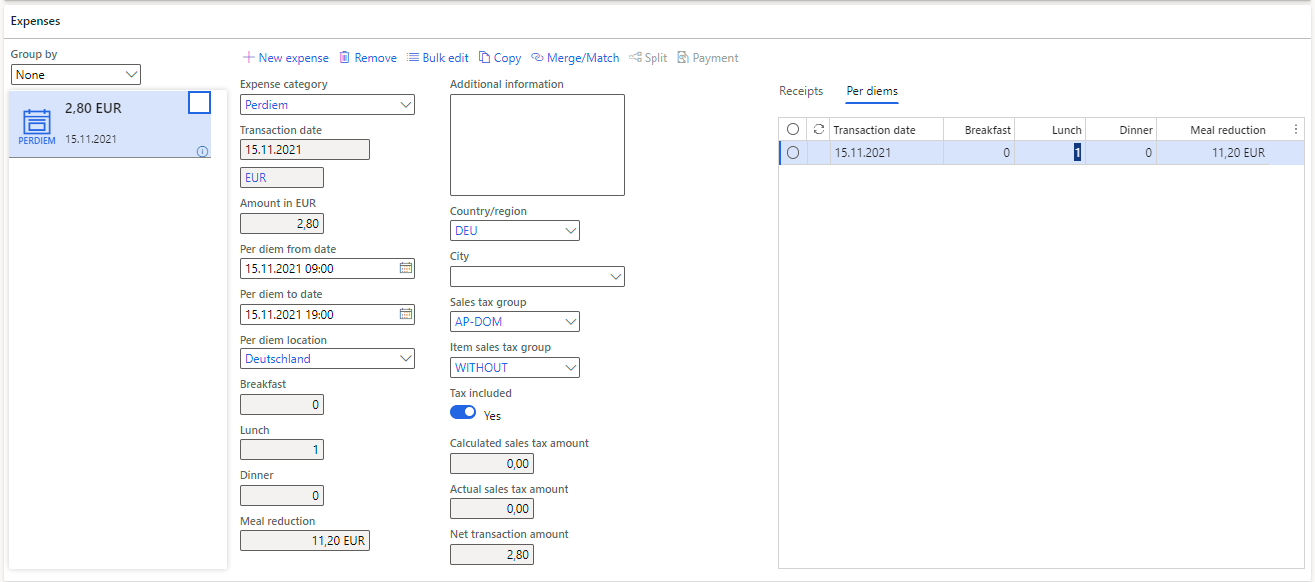

In Expense management > My expenses > Expense reports, add a new report, choose the location, add a new line PerDiem. The UI automatically switches to the detailed mode where you can enter the start and the end date/time of your trip and choose the Per diem location:

On the Per diems tab, set Lunch = 1. The reduction of €11,20 is applied as expected, and the total allowance amount becomes €2,80. To post the expense report an approval workflow has to be in place.

Remember, a one-day trip less than 8 hours does not count as business travel. The per diem rate tiers cannot be used to enforce it, but here are 2 possible alternatives:

- solve it organizationally, establish “human-driven” approval rules

- make a small extension to the class TrvRuleExpressionSetup to enable the total trip duration, the start and the end date as parameters in the expense policy definition:

public FromDate parmPerDiemFromDate(CompanyId _companyId, TableId _tableId, RecId _recId)

{

TrvExpTrans trvExpTrans = TrvExpTrans::find(_recId);

return DateTimeUtil::date(DateTimeUtil::applyTimeZoneOffset(trvExpTrans.DateFrom, DateTimeUtil::getUserPreferredTimeZone()));

}

public ToDate parmPerDiemToDate(CompanyId _companyId, TableId _tableId, RecId _recId)

{

TrvExpTrans trvExpTrans = TrvExpTrans::find(_recId);

return DateTimeUtil::date(DateTimeUtil::applyTimeZoneOffset(trvExpTrans.DateTo, DateTimeUtil::getUserPreferredTimeZone()));

}

public Hours parmPerDiemHours(CompanyId _companyId, TableId _tableId, RecId _recId)

{

TrvExpTrans trvExpTrans = TrvExpTrans::find(_recId);

return any2real(DateTimeUtil::getDifference(trvExpTrans.DateTo, trvExpTrans.DateFrom)/3600);

}

Continued…

Expense management blog series

Further reading:

German travel expenses in Dynamics 365 Part 2

German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

On currency in credit card expense transactions Part 2

On currency in credit card expense transactions Part 1

D365: Import Mastercard CDF3 statements OOTB

Configuring Austrian and Norwegian per diems in Dynamics 365

3 Comments

Hi Eugen, many thanks for this blogpost. I have a question regarding “Case 1”. My customer is saying that for the departure day, the meal deduction should be relative to the reduced daily allowance rate; so for instance lunch reduction should be 40% of 14 EUR and not 40% of 28 EUR. Do you know if this is supported? Thank you, Fjorela

Hello, technically, yes:

Just update these to 10%-20%-20%

Can they prove it? A law, URL link, a court or a ministerial edict? Because this does not make a lot of sense: if you’ve eaten a lunch the 1st day, will you use just a half of its nutritional energy sitting in the train on the day of arrival? 🙂 I know, the laws are often nonsensical.

As discussed offline, your customer misinterpreted the legislation. Since there is a special clause that the meals reduction may not turn negative, the reduction cannot possibly fall in the same proportion as the daily rate, i.e. the reduction is not affected by the 1/2 rule: