On provisions, accruals and deferrals

- Eugen Glasow

- December 31, 2017

- 2:06 pm

- No Comments

It’s the holiday season, time to close the accounting year, accrue prepaid expenses in your books and build provisions for anticipated losses, reducing your corporate tax base and saving money.

If an AP invoice for goods or services has been received at or before the year end but relates to the next year or financial period, this prepaid expense is classified an asset in the balance and it should be removed from the current P&L:

Debit “7x Office rental” Credit “1x Cash”.

Debit “2x Prepaid expense” Credit “7x Office rental”.

If an invoice for anticipated expenditures or contractual obligations has not been received yet, but relates to the current accounting year, this provision is represented by a liability in the balance:

Debit “7x Audit” Credit “3x Provision”.

In “Dynamics 365 for Finance and Operations (EE)” there are in essence 3 methods to record these accruals, each with its own benefits and shortcomings: Reversing entry, Accrual schemes and Deferrals.

Reversing entry

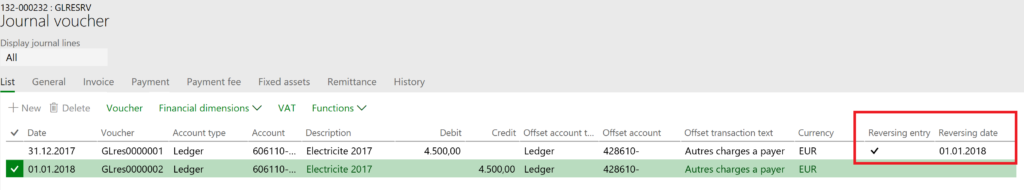

The Reversing entry feature is good for provisions if they are not allocated over time / accounting months, but built on the 31th of December and dissolved immediately on the 1st of January.

In the basic General ledger > Journal entries > General journal, you just tick the Reversing entry checkbox and enter the Reversing date. On posting the journal, the system automatically adds a second journal line where it swaps the debit with the credit:

This simple feature fulfils the purpose of reducing the tax load in the financial year, but

- it is not appropriate to allocate the expenditure over multiple periods, and

- it books the second voucher in the future period. It is a good accounting practice to only keep one accounting period open, which is going to manifest itself in the error message “The financial period is closed for module Ledger on the date 01.01.2018”.

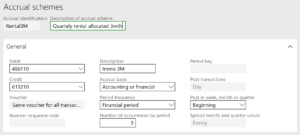

Accrual schemes

The Accrual schemes are better in the sense that they are capable of allocating prepaid expenses over time, but share many disadvantages with the Reversing entry:

- accrual schemes are only available in the General Ledger journal and cannot be applied to an AP invoice;

- they record transaction in future [closed] financial periods, and these transactions are final and cannot be changed;

- an accrual scheme cannot reverse the provision entry at the end of the designated period.

The feature was made in an assumption that the expense to accrue is posted/debited in the same voucher, which in a large organization may defy the principle of segregation of duties as embodied by different forms to enter the invoice (AP Pending invoice form) and to accrue it (GL journal).

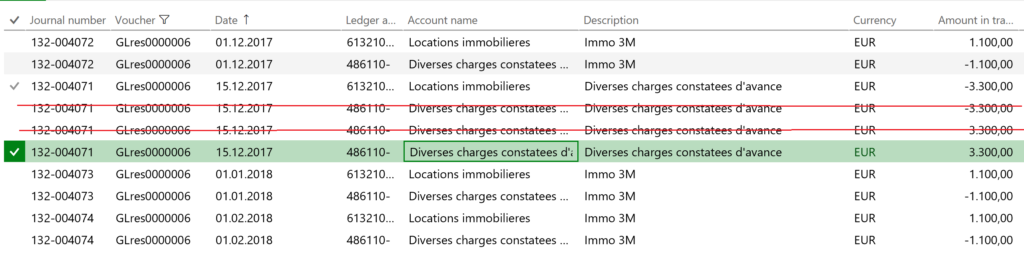

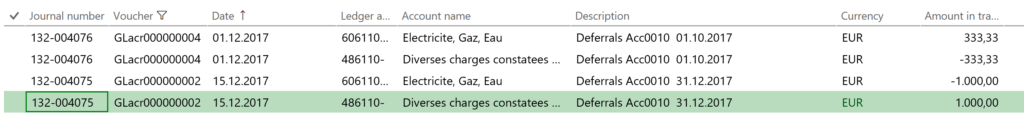

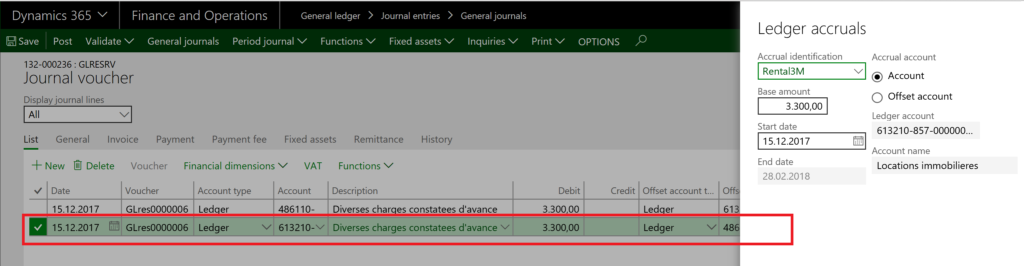

In the below example an General ledger > Journal setup > Accrual scheme

is triggered in the GL journal line by clicking Functions > Ledger accruals. On the screenshot below the accrual was applied to a contra-intuitive second line in the GL journal line. This was to trick the system into the desired Dr Expense Cr Prepaid posting (use the Transactions button in the Ledger accruals dialog box to preview the result): The resulting GL voucher resembles a battlefield, but can be reduced to the following: 1/3 of the expense was recognized, 2/3 of the prepaid expense remained in the balance:

The resulting GL voucher resembles a battlefield, but can be reduced to the following: 1/3 of the expense was recognized, 2/3 of the prepaid expense remained in the balance:

Deferrals

Since the early versions of Dynamics (namely, Axapta 3.0) there has been a sub-ledger called Deferrals in the Russian localized version: https://technet.microsoft.com/en-us/library/jj678354.aspx. It is free of the Accrual scheme handicaps, because it keeps the evidence of prepaid expenses and provisions in a separate ledger and does not impose GL transactions in future periods. It resembles the Fixed Assets module and supports 3 types of operations (transaction types):

- The co-called ‘Receipts‘, i.e. records ‘zeroing out’ the expense amount in the AP invoice period,

- ‘Writing off‘, i.e. recurring prorated transactions allocated over a number of accounting periods and posted on the 1st of every period,

- The so-called ‘Retirement‘ or Disposal, i.e. dissolving a provision.

Since AX2012 this sub-module has only been available in a legal entity with the primary address in Russia. In the latest releases of “Dynamics 365 for Finance and Operations (EE)” it became possible to extend all RDeferrals* application elements, add country codes and ‘jailbreak’ the desired function.

To implement the Deferrals module in Switzerland, I infused it with a multi-currency capability to store the currency code and the exchange rate in the Deferrals table, and populate the fields Currency, Exchange rate and the Secondary exchange rate in the journal lines. To increase productivity of the accountant the AP Pending invoice was enhanced to create Deferrals records automatically for every line (or expense account in the distribution). Furthermore, the Main account in the deferrals model table was customized to uptake the individual expense account from the AP invoice line and simplify the setup compared to the Accrual schemes: there should be no need to create an own Scheme for all 50+ expense accounts in question.

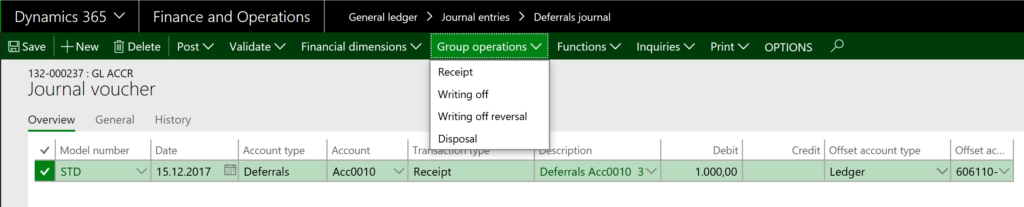

The process begins with the registration of a prepaid expense in the General Ledger > Common > Deferrals list. The new Deferrals [model] record becomes the status Scheduled i.e. awaiting the ‘Receipt’. The Receipt operations are proposed by the system in the General ledger > Journal entries > Deferrals journal, they intend to credit and hence neutralize the expense in the current accounting period: The monthly allocation is performed in the similar manner where the user creates a new Deferrals journal and uses the button Group operations > Writing off in the Lines. This generates outstanding transaction proposals en masse for all accrual records in the status ‘In process’ up to the Transaction date specified:

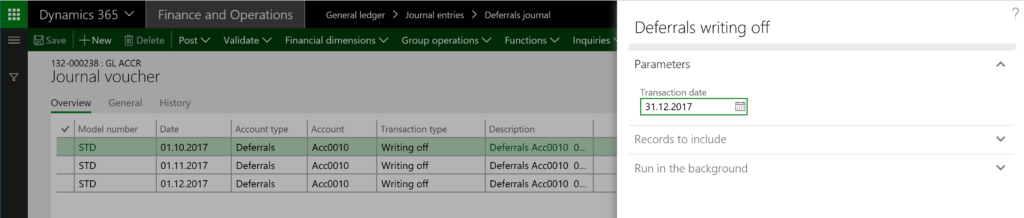

The monthly allocation is performed in the similar manner where the user creates a new Deferrals journal and uses the button Group operations > Writing off in the Lines. This generates outstanding transaction proposals en masse for all accrual records in the status ‘In process’ up to the Transaction date specified:

N.B: In standard Dynamics due to some wicked design decision, the horizon for the transactions is the end of the month preceding the Transaction date. I.e. a Transaction date = 31.12.2017 brings transactions up to the 1st of November.

Revenue recognition and deferred cost blog series

Revenue recognition and deferred cost blog series

Further reading:

Revenue recognition with project budget shadow forecasts

Bundles (Revenue recognition)

Accrued revenue (Revenue recognition)

On provisions, accruals and deferrals