Electronic reporting: Italian eInvoicing FatturaPA, CIG and CUP numbers, RIBA

Introduction

The use of eInvoices in public procurement in Italy is mandatory for ministries, tax agencies and national security agencies since June 2014. Since 31 March 2015, it is mandatory for all public entities. We also see private companies embarking this platform. Every supplier must comply and provide invoices in the “FatturaPA” format which is perfectly described in English (!) here.

In Dynamics 365 for Finance and Operations, the [public] client must have the parameter eInvoice set to Yes to activate electronic invoicing. If the eInvoice attachment has been activated as well, D365FO even embeds a copy of the invoice into the XML stream (as a PDF encoded by Base64 algorithm and stored in a CDATA block).

The eInvoices are driven by the Electronic Reporting. As I am writing this, the most recent version is the format “Sales invoice (IT)” v 29.34, based on the “Customer invoice model” and mapping v 29 from the 15th of January 2019.

In essence, you download the above 2 configurations, deploy them at Organization administration > Electronic reporting > Configurations, put an anchor on the Electronic documents tab at Accounts receivable > Setup > Accounts receivable parameters.

With this setup on hand, you post your sales or project invoice and it creates a record in the Accounts receivable > Invoices > E-Invoices > Electronic invoices list. These records are then processed manually or in a batch and the ER generates and drops XML files.

The problem is, the output is full of bugs.

DatiOrdineAcquisto, CodiceCIG, CodiceCUP, RiferimentoNumeroLinea

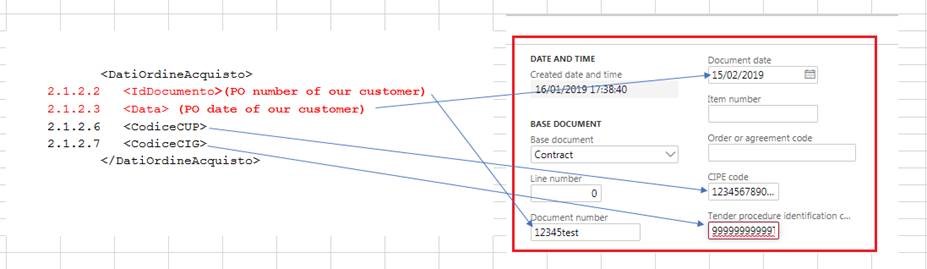

To crack down on mafia, the government issues CUP and CIG codes to identify contracts or assignments with public investments. They are tracked end-to-end from the invoice down to the payment (e.g. RIBA bills of exchange, see below). In Dynamics 365, these numbers need to be entered into the Base document part in the sales order header. As you post the sales invoice, it creates a persisting copy of the BaseDocument_IT record and attaches it to the invoice record CustInvoiceJour. The ER picks it up and the Base document type triggers one of the 5 sections <DatiOrdineAcquisto>, <DatiContratto>, <DatiFattureCollegate> and so on. So much for theory.

The code in \Data Dictionary\Tables\BaseDocument_IT\Methods\updateRefRecords is wrong in so many ways. It is going to fail creating a record for 2 invoices for the same order, 2 orders for the same public tender. The ER cannot find the record BaseDocument_IT, and the section <DatiOrdineAcquisto> is then missing in the output.

To mitigate this, you must create a mapping derived from Customer invoice model, declare it Default for model mapping and put a fallback into the InvoiceBase/BaseDocument_IT node:IF(NOT(ISEMPTY(CustInvoiceJour.'<Relations'.BaseDocument_IT)),

CustInvoiceJour.'<Relations'.BaseDocument_IT,

CustInvoiceJour.'salesTable()'.'<Relations'.BaseDocument_IT)

Furthermore, the user may fail to provide the Line number in the Base document group. As a result, the <RiferimentoNumeroLinea> XML element is going to be missing in the output. The FatturaPA documentation told this element was not mandatory but in practice it is.

You need to derive a custom format from “Sales invoice (IT)” and improve it by substituting an empty line number (if not entered by the user) with “1” as long as any of the Base document types in the SO header has been selected. The below change needs to be replicated 5 times for the 5 respective types of the public sector Base documents.

For example, the node XMLHeader/p:FatturaElettronica/FatturaElettronicaBody/DatiGenerali/DatiOrdineAcquisto/RiferimentoNumeroLinea can be bound toIF(@.LineNumber>0, @.LineNumber, 1)

RIBA CIG and CUP codes in the record 50

The Ri.Ba. is an electronic format for exchange bills remittances common in Italy. It is well described by bella Mrs. Santoro: Italian Ri.Ba. (Bill of Exchange) setup and process. This guidance was for AX2009, but the process remained the same and is valid in all points with the exception of the data export engine.

The current version of the ER configuration is “RIBA collection remittance (IT)” v 25.27 based on the “Payment model” 25 with the mapping “Payment model mapping 1611” v 25.27.

In the record 50 of the remittance it should provide the CIG and CUP codes in a long string. With the BaseDocument_IT record missing, this is going to fail. The workaround is similar: in a custom derived model at 2 places with@.'$CustInvoiceJour'.'<Relations'.BaseDocument_IT.xxx

you need to putIF(NOT(ISEMPTY(@.'$CustInvoiceJour'.'<Relations'.BaseDocument_IT)),

@.'$CustInvoiceJour'.'<Relations'.BaseDocument_IT.TenderCode,

@.'$CustInvoiceJour'.'salesTable()'.'<Relations'.BaseDocument_IT.TenderCode)

CodiceFiscale and IdCodice

The own VAT Code (e.g. IT00XXXXXXXXX) may differ from the Fiscal code (e.g. 00YYYYYYYYY) which is entered in a separate field CoRegNum in the company information. The eInvoice format in D365FO takes wrongly the Fiscal Code for the VAT Code value. You need to derive a custom format from Sales invoice (IT), and replace the binding for the <IdCodice> element and its “Enabled” (“?”) condition withInvoice.InvoiceBase.CompanyInfo.VATNumber

Similarly, the EU VAT number of the customer may not match the fiscal code; moreover, the standard ER configuration erroneously takes the data from the Order customer in the sales order and not the Invoice customer account.

First and foremost, in the mapping the FiscalCode of the customer is not bound to the table. Fix this, then replace the binding in the derived format at 3 places and 3 conditions like this:Invoice.InvoiceCustomerAccount.FiscalCode

Continued: Italian eInvoicing FatturaPA: Part 2

E-invoice and configurable business documents blog series

Further reading:

ZUGFeRD 2.3.x export/ Factur-X 1.07.x for Dynamics 365 FO

ZUGFeRD 2.3.x import for Dynamics 365 for Finance

Filling PDF Forms with Electronic Reporting in Dynamics 365 for Finance

Aktueller Stand der eRechnung in D365 for Finance (Deutschland)

Austrian Peppol-UBL e-invoice

How NOT to send an order confirmation per e-mail

Enumerate lines in Configurable Business Documents

Canvas sections in D365 Configurable Business Documents

Italian eInvoicing FatturaPA, CIG and CUP numbers, RIBA

Italian eInvoicing FatturaPA: Part 2