On currency in credit card expense transactions – Part 1

Introduction

The Expense management module in D365FO comes with an interface to credit card providers. I addressed this topic in an old blog of mine: visa-vcf-plain-text-credit-card-statement-into-dynamics-ax-with-xslt. Imported credit card transactions end up in the [Unattached] Credit card transactions list, ready to be taken over by the employee into an expense report.

There used to be a lot of misunderstanding with regards to the different currency rates and amounts and their meaning. Moreover, for a decade the Dynamics system had been posting the liability in the merchant transaction currency, which led to the expense report being split by currency code on posting into the AP ledger. It was wrong in many ways until we fixed it in a tremendous collaboration effort with Microsoft Support in 2018.

Case 1: credit card currency = accounting currency

In the expense report line there is an obligatory Payment method associated with the credit card type. It mandates how the employee is reimbursed for this part of the expense report. Typically, the Payment method (Expense management > Setup > General > Payment methods) is configured with the Offset account type = Worker which creates a liability against the AP account (vendor) associated with the employee.

If this liability is expressed in a currency different from the accounting currency of the legal entity, it starts accumulating exchange rate difference. If the payment takes place in a different accounting period, the employee may be reimbursed too much or too little. Indeed, the credit card it typically bound to a bank account of the employee, and the exchange rate charged by the bank to the cardholder is very unlikely to be the same as the current corporate exchange rate maintained in D365FO. Ergo, the AP transaction should be expressed in the accounting currency.

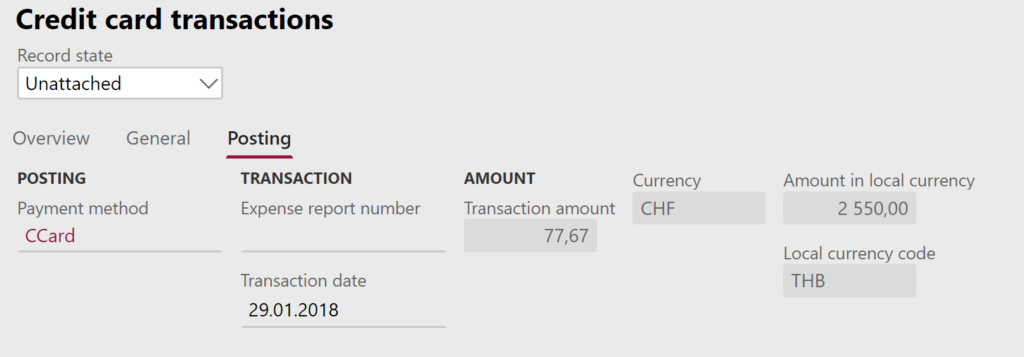

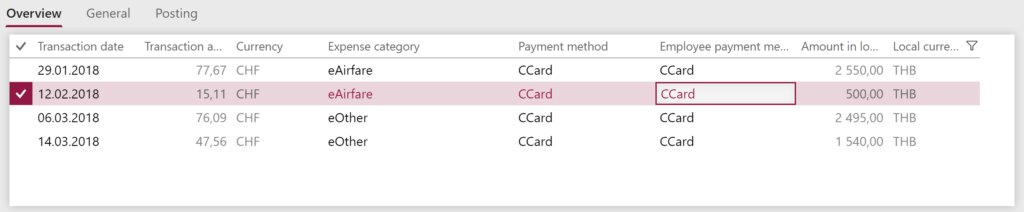

Take a look at the below example, the employee visited Thailand:

- The Local currency code is not what you would expect but the currency the merchant charged the transaction in, here the Thai baht. Internally it is called EXCHCODE_LOCALCURRENCY.

- Amount in local currency is the transaction amount in baht

- The Currency code is the currency the credit card issued in (a.k.a. EXCHCODE_CREDITCARDCURRENCY), typically the currency of the state where the cardholder lives (here: the Swiss Franc)

- Transaction amount is the amount the credit card issuer will settle against the bank account backing the credit card, i.e. an amount in CHF to be withheld from the cardholder at the end of the month. Internally it is called AMOUNT_CREDITCARDCURRENCY.

The exchange rate between the “Local currency” and the “Currency” must not follow the standard exchange rate setting in D365FO, but it should be what the credit card institute provides on the account statement. Take the next example (Expense management > Periodic tasks > Credit card transactions):

The exchange rate was developing over the same time span as shown below:

01.01.2018 2,995 CHF for 100 THB

01.02.2018 2,975 CHF for 100 THB

01.03.2018 3,001 CHF for 100 THB

The exchange rate applied by the bank in February was 15,11 CHF/ 500 THB = 0,03022 CHF/THB = 3,022 CHF for 100 THB. Clearly, it was higher than the average to the disadvantage of the employee, right as expected of a greedy bank.

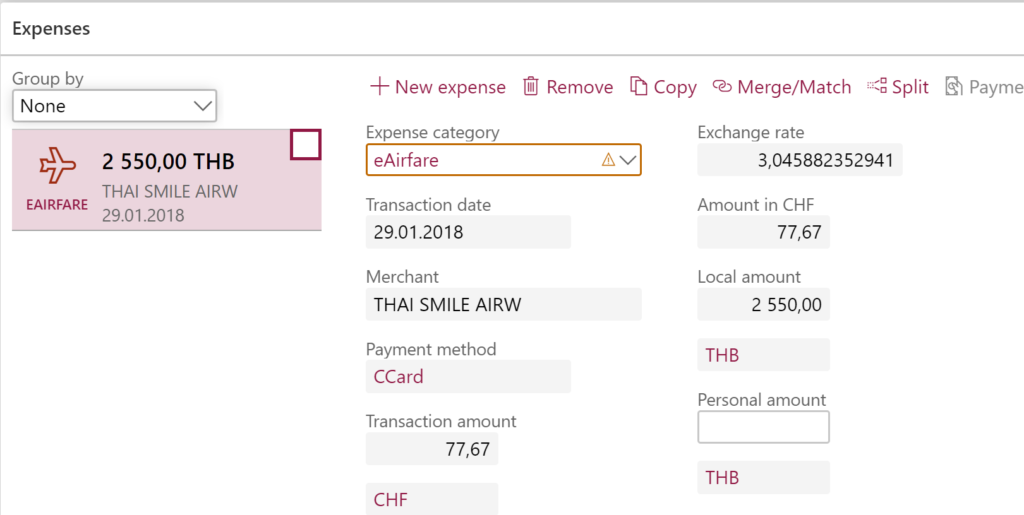

What will you see in Dynamics 365 for Finance and Operations (version 8.x+, all bugs fixed) upon attaching the imported credit card transactions to an expense report and posting the same?

- Expense report line currency: THB

- Expense report line Transaction amount and currency: 77,67 CHF (!)

- Expense report line Local amount: 2550

- Accounting distribution currency and amount: 2550 THB

- Expense report line Exchange rate: 3,046 CHF/100 THB, not editable (*)

- GL Voucher transactions: Debit expense THB – Credit liability THB (**)

- AP Subledger transaction: Credit liability CHF (!!)

(*) This is the unique exchange rate as charged by the credit card provider, and not the default legal entity exchange rate on the transaction date.

(**) The GL transaction currency does not match the subledger currency, as you can see. In theory, it is possible to have voucher transactions with the debit in one currency (THB) and a credit on another currency (CHF), as long as the equivalent in the local currency (CHF) matches and the voucher is in balance. However, it was not feasible for Microsoft to implement it in the subledger / accounting distribution programming model.

To be continued: Part 2

Expense management blog series

Further reading:

German travel expenses in Dynamics 365 Part 2

German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

On currency in credit card expense transactions Part 2

On currency in credit card expense transactions Part 1

D365: Import Mastercard CDF3 statements OOTB

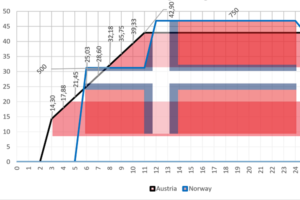

Configuring Austrian and Norwegian per diems in Dynamics 365