German travel expenses in Dynamics 365 – Part 2

- Eugen Glasow

- January 4, 2022

- 12:49 pm

- No Comments

Confinued from German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

Domestic business travel – Case 2 “3 days of training with hotel”

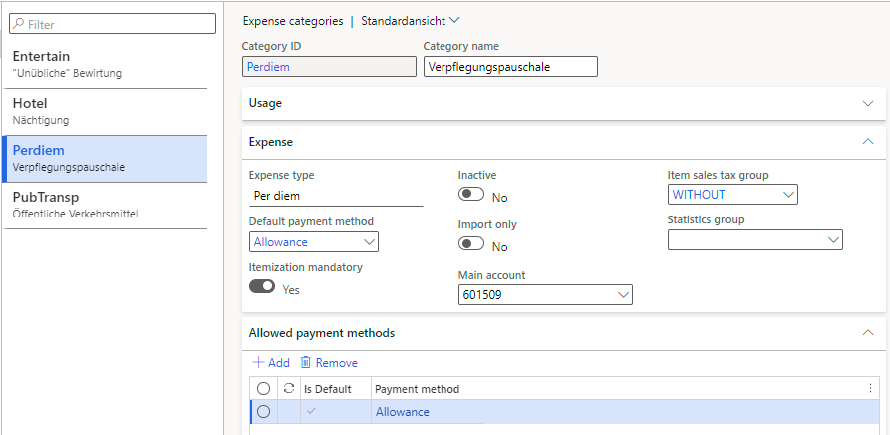

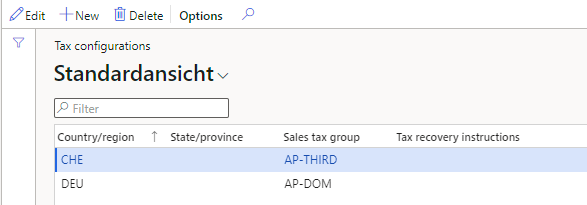

The 2nd case requires a receipt, a bill for the accommodation at a hotel. The VAT from domestic invoices may be recovered, and we need a country-specific setup for the VAT (…> Setup > General > Tax configurations) where the host country is associated with a tax group containing both full (19%) and reduced (7%) tax codes.

Set up an additional category of the type “Hotel”, assign the reduced 7% tax group to this category. Let the user enter a line against his category as an amount including tax, and select the Country/region = DEU. The domestic VAT is derived automatically by the system: €9,58.

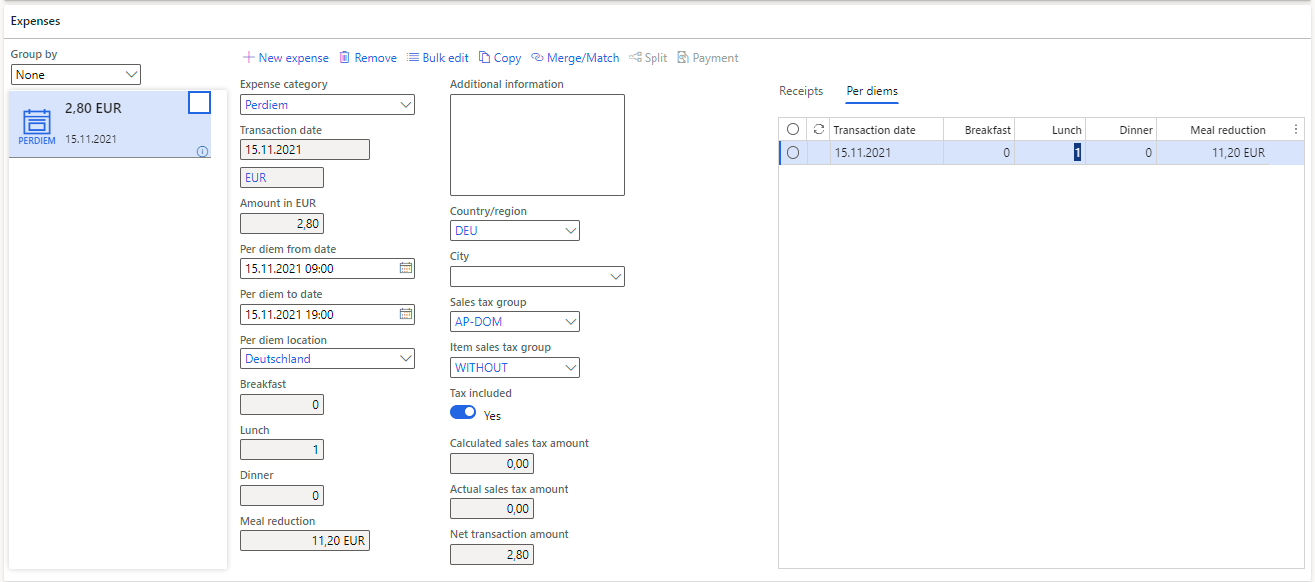

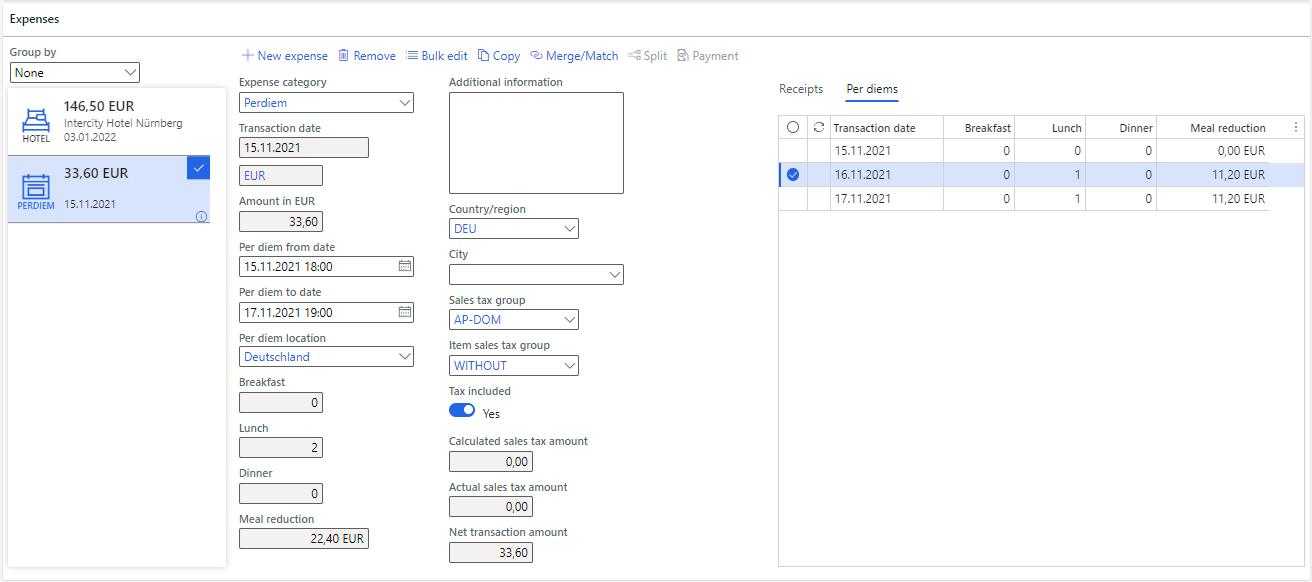

The two lunches reduce the per diems by €22,40 down to €33,60 as required:

Domestic business travel – Case 3 “Hotel breakfast”

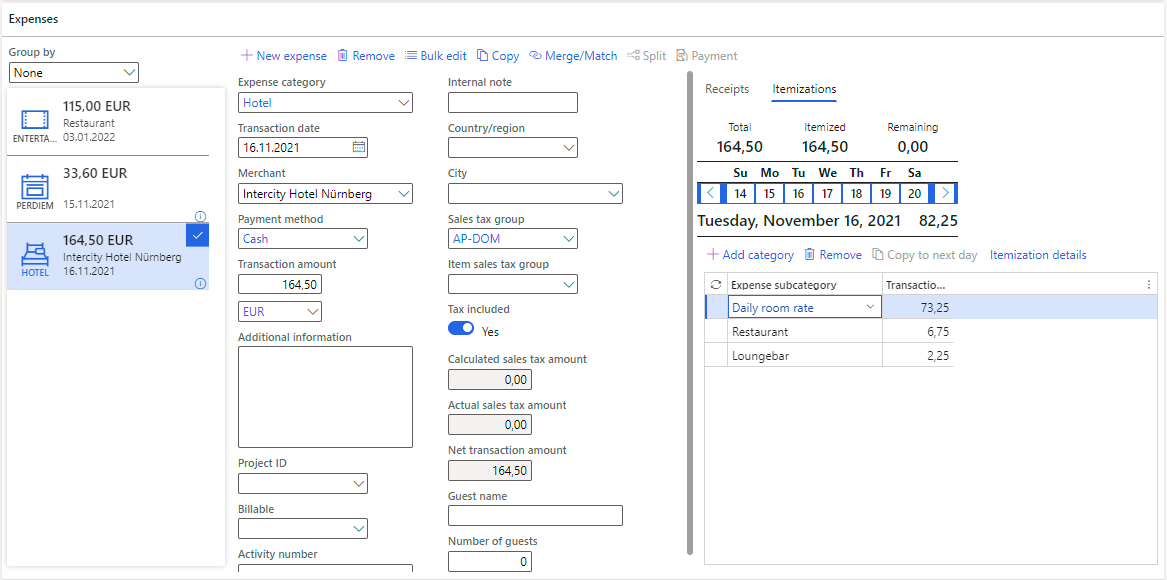

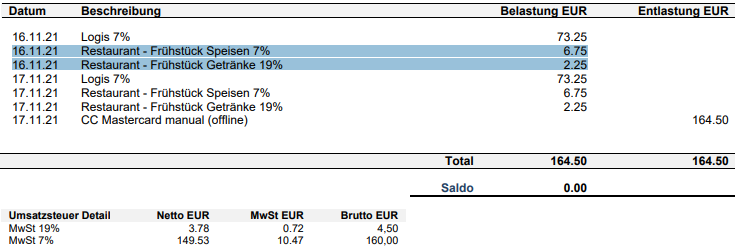

This time the hotel served Erika breakfasts. The breakfast is presented on the bill separately, since the accommodation and meals are subsidized through the reduced VAT of 7%, but beverages other than water are taxed at the full rate of 19%:

This requires an “Itemization” and at least 2 expense Subcategories under the main expense category Hotel. You can deactivate all standard subcategories but the Daily room rate, Restaurant and Loungebar and apply the full rate to the latter. The VAT amount by the “item” can be reviewed under Itemization details, the total VAT amount from the itemizations is not visible elsewhere.

If this is considered an unreasonable workload, you may abandon the itemization and simply edit the total VAT receivable in the Actual VAT amount field.

The entertainment (de: Bewirtung) may be dealt with similarly: 2 subcategories or even 3, as the tips (de: Trinkgeld) are VAT free. A mandatory list of guests may be enforced with a travel expense policy (Expense management > Setup > Policies > Expense report) where a submission to the workflow is prevented with an error message if the Number of persons entertained = 0 for any expense category of the Entertainment type:

Case 4 “Travelling abroad”

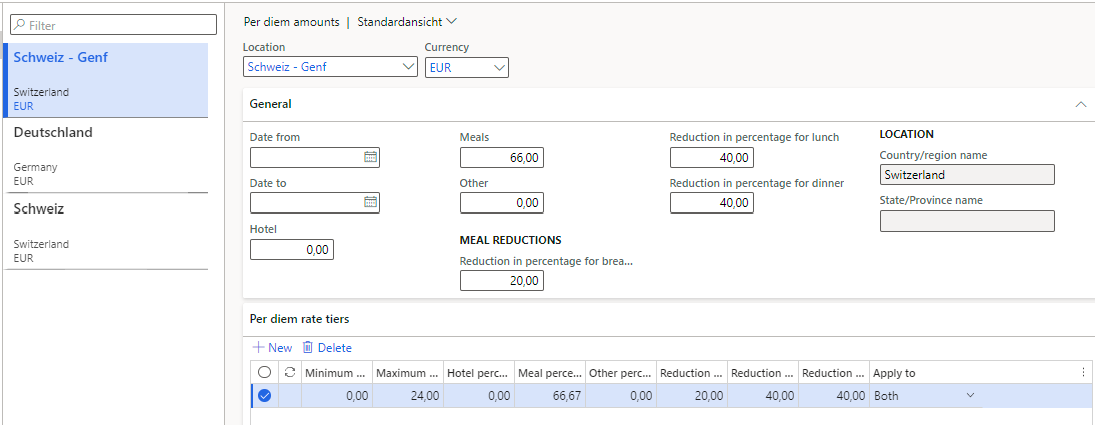

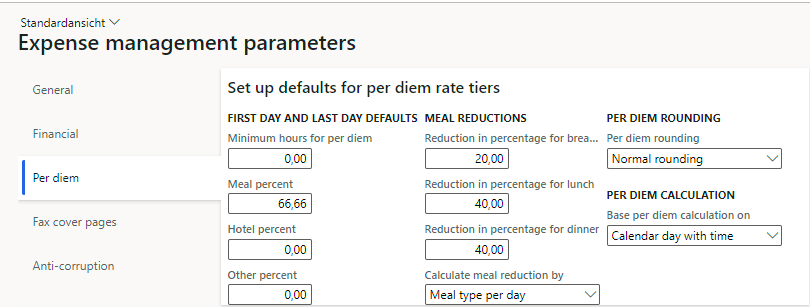

As we have learned already, daily allowances are country-specific. The reduced domestic rate for Germany is 50%, but the reduced foreign rates are close to 66% (but not exactly): here is an example for Switzerland, note the ratio:

| Full 24h day | “First/last day” | Ratio | |

|---|---|---|---|

| Switzerland | |||

| – Geneva | €66 | €44 | 66,67% |

| – the rest of Switzerland | €64 | €43 | 67,19% |

The reduced rates are rounded by the government to whole euros. To match the reduced foreign rate, I use a tailored percentage. It should approximate the daily rate with a deviation less than €0,01:

44/66 = 0,6666… => 66,00 * 66,67% = 44,0022 ~= 44,00

43/64 = 0,671875 => 64,00 * 67,19% = 43,0016 ~= 43,00

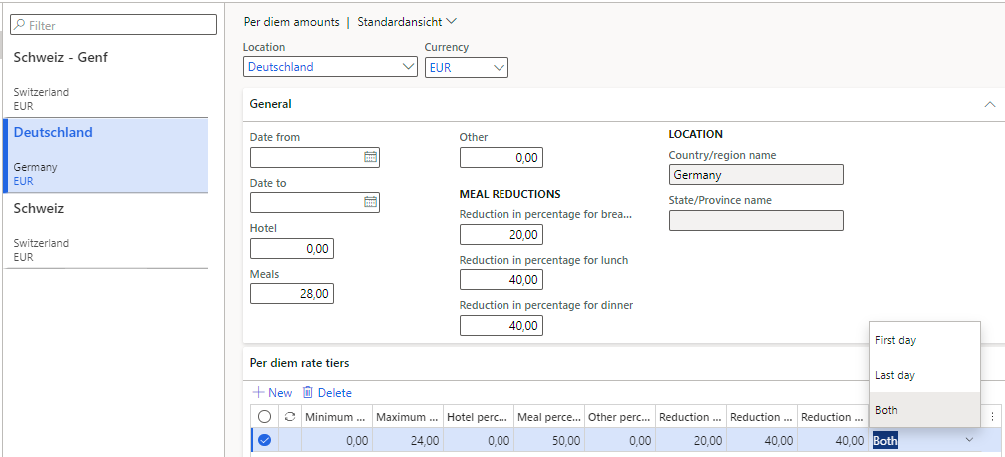

The respective setup of per diems and tiers per location is shown on the following screenshot:

Note that the rates are updated by the BMF every year and have to be regularly re-imported with validity dates. This is also true for the calculated percentage for first/last day.

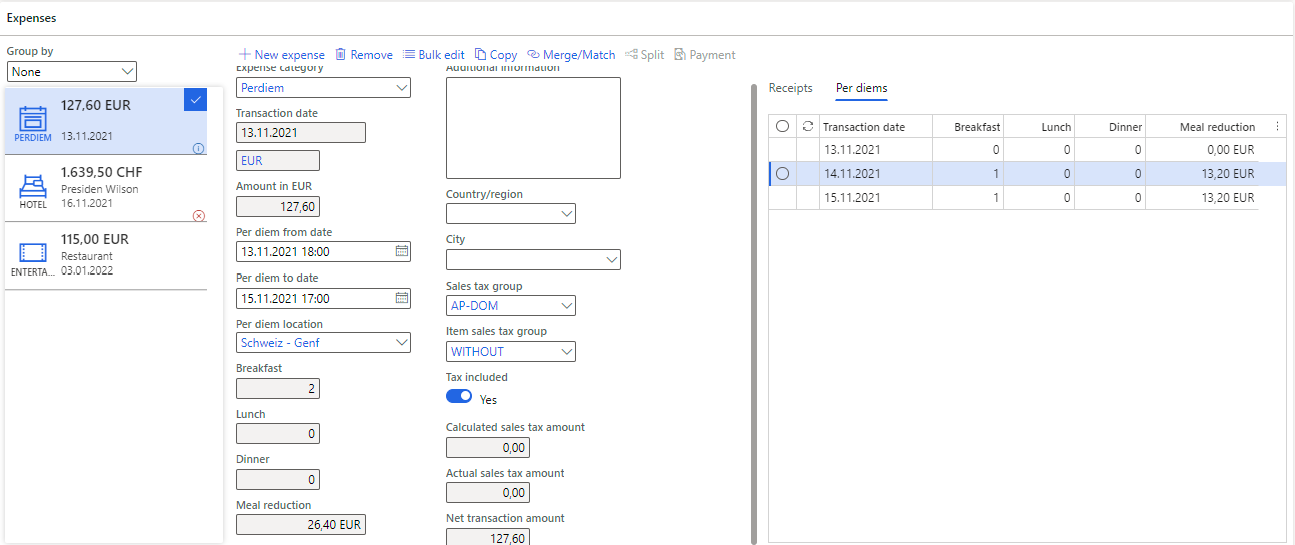

The meals reduction and per diem calculation now caters for the rates in Geneva:

Switzerland does not belong to the EU, and their foreign VAT on the hotel bill is not recoverable, the selection of the right country code removes the VAT. No itemization is needed, the hotel bill may be entered as a lump sum in Swiss francs. The amount paid in Swiss francs is converted to euro at the intrinsic System exchange rate type, or at a user-defined rate.

Expense management blog series

Further reading:

German travel expenses in Dynamics 365 Part 2

German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

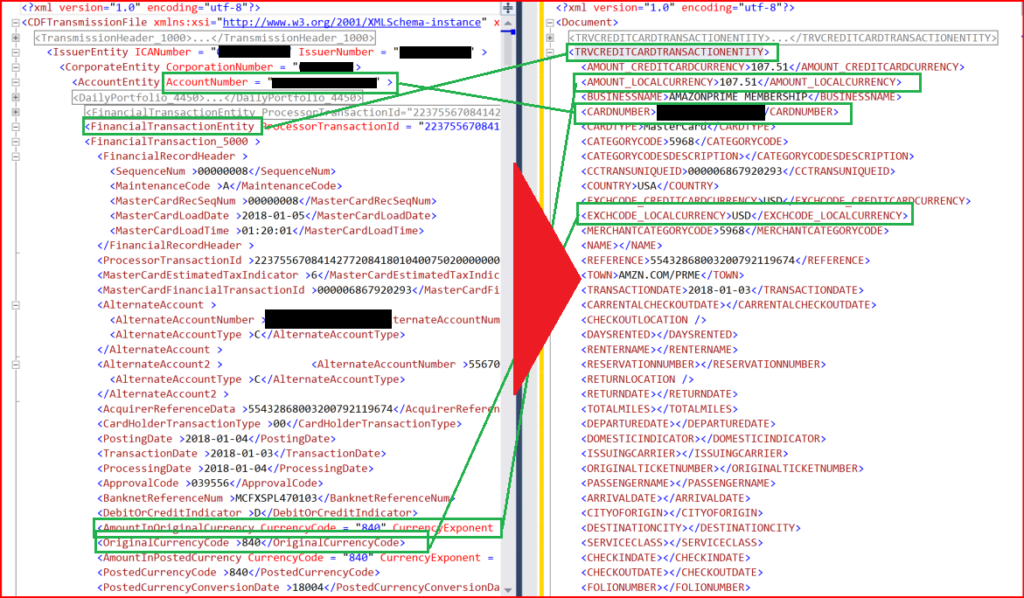

On currency in credit card expense transactions Part 2

On currency in credit card expense transactions Part 1

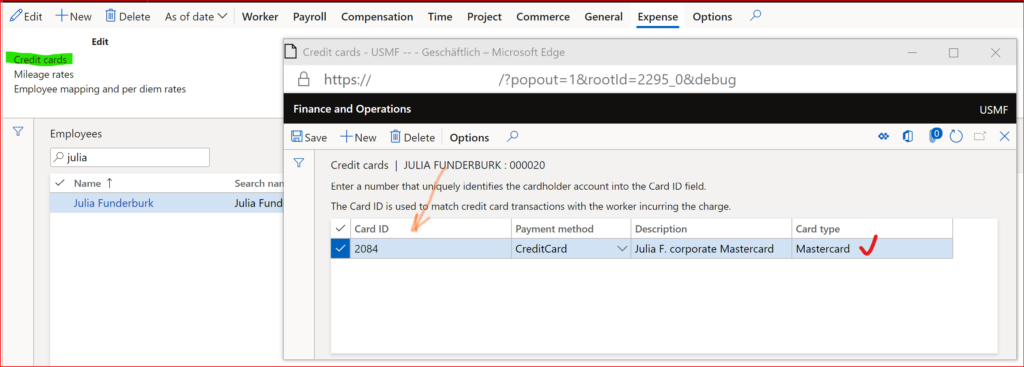

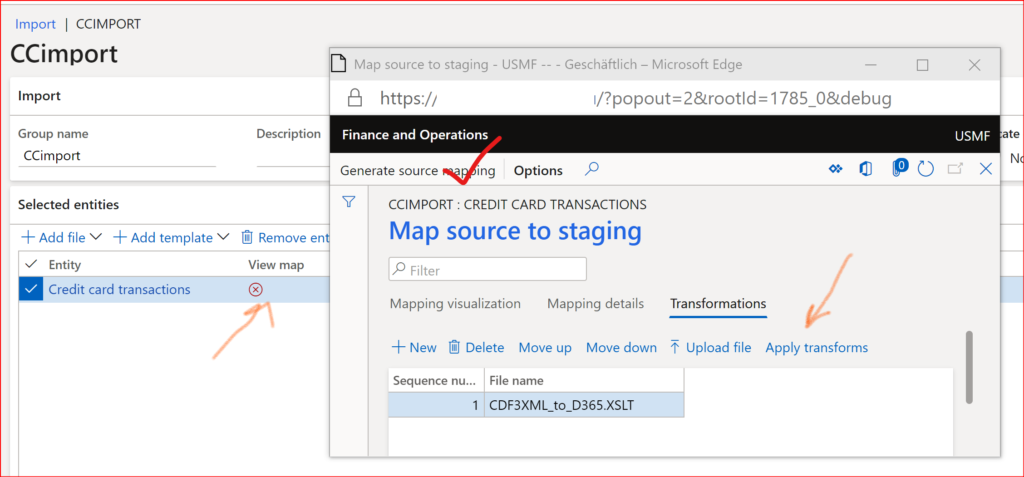

D365: Import Mastercard CDF3 statements OOTB

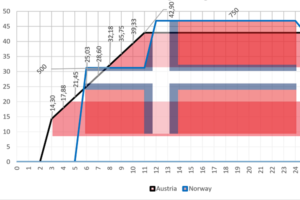

Configuring Austrian and Norwegian per diems in Dynamics 365