On currency in credit card expense transactions – Part 2

- Eugen Glasow

- August 7, 2019

- 10:40 pm

- No Comments

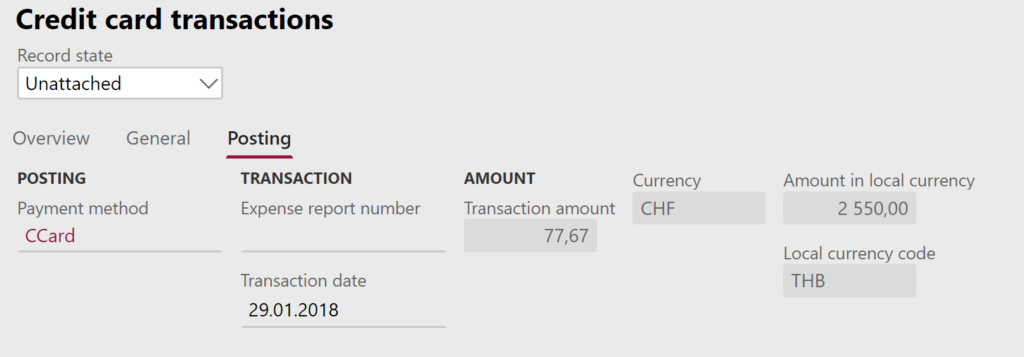

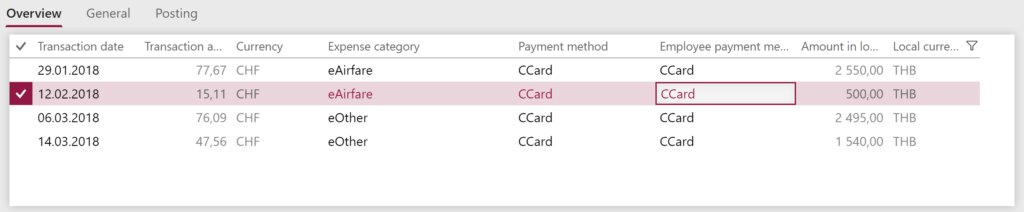

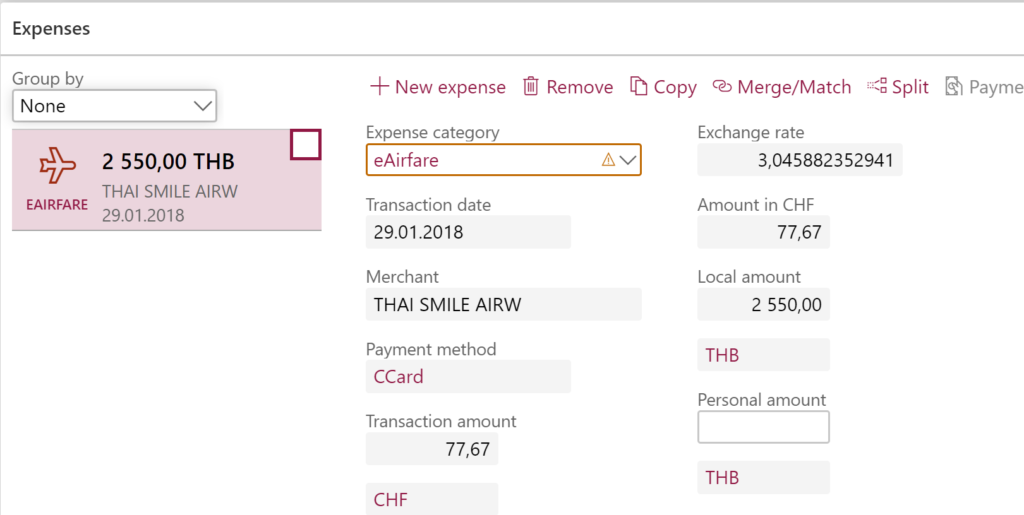

In the previous blog On currency in credit card expense transactions – Part 1 we have explored a case where the credit card currency and the local accounting currency in D365FO did match. But what if the card is issued in a currency different from the accounting currency of the legal entity?

(*) The accounting currency HUF equivalent i.e. ‘amount MST’ is evaluated through the rate EUR -> HUF

(**) Note the currency mismatch between the AP and GL ledgers. This spoils the AP ledger account with transactions in foreign currencies and may potentially kick the subledgers off balance.

Case 2: credit card currency <> accounting currency

For example, Hungarian employees (the official currency of Hungary is the Forint, abbreviated as HUF) may be given credit cards billed in Euro, since they are surrounded by the Euro zone. If we follow the same logic as before, if such a credit card statement is expressed in EUR, then it must be posted in EUR into the AP subledger:- 01.06.2019 Paid a hotel in Bratislava 500 EUR (the credit card provider applied the cross rate of 1.00)

- 04.06.2019 Posted in AP subledger as 500 EUR (the daily rate was 322 HUF/EUR)

- 30.06.2019 The credit card balance of June was withdrawn by the bank from the employee’s daily account in HUF @323,39 = 161 695 HUF. This is not recorded in D365FO for personal credit cards.

- 30.06.2019 An AP revaluation is performed in D365FO. The liability is now worth 161 450 HUF at the current exchange rate of 322,9 HUF/EUR

- 01.07.2019 The employee is reimbursed in the local currency by the employer with 161 450 HUF @322,9 HUF/EUR.

Case 3: credit card currency <> accounting currency <> local currency

What if the trip was not to Slovakia (EUR) but to the Czech Republic who refused to adopt the Euro and retained their own Czech koruna (CZK)? Now all 3 currencies in the transaction are different:- The legal entity Accounting currency = HUF

- The transaction Local currency = CZK

- The Credit card Currency = EUR

| Case 1 | Case 2 | Case 3 | |

|---|---|---|---|

| Credit card Currency | CHF | EUR | EUR |

| CC “Local” currency | THB | EUR | CZK |

| Accounting currency | CHF | HUF | HUF |

| Expense line | THB | EUR | CZK |

| Line itemizations | THB | EUR | CZK |

| Acc. distribution | THB | EUR | CZK* |

| GL voucher | Dr THB – Cr THB** | Dr EUR – Cr EUR | Dr CZK – Cr CZK** |

| AP subledger | CHF | EUR | EUR |

Expense management blog series

Further reading:

German travel expenses in Dynamics 365 Part 2

German travel expenses in Dynamics 365 / Deutsche Reisekostenabrechnung 2022

On currency in credit card expense transactions Part 2

On currency in credit card expense transactions Part 1

D365: Import Mastercard CDF3 statements OOTB

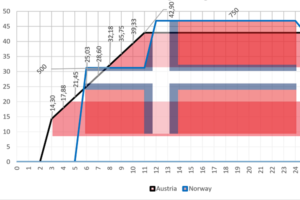

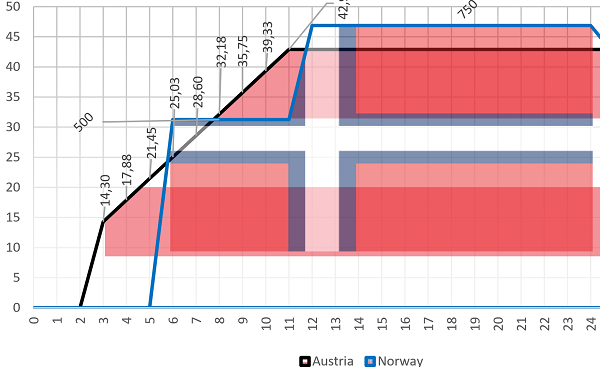

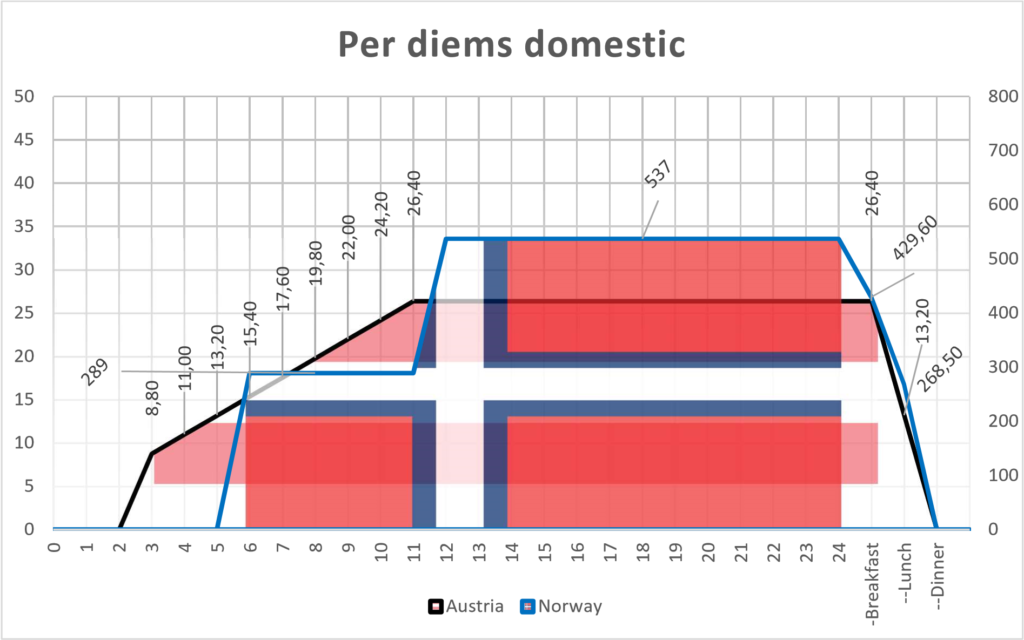

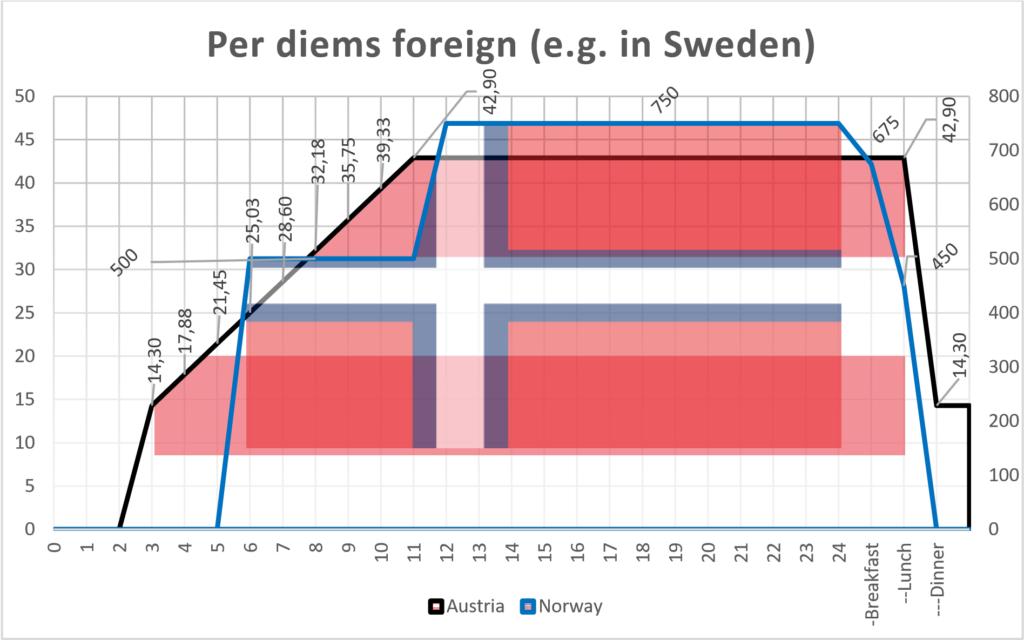

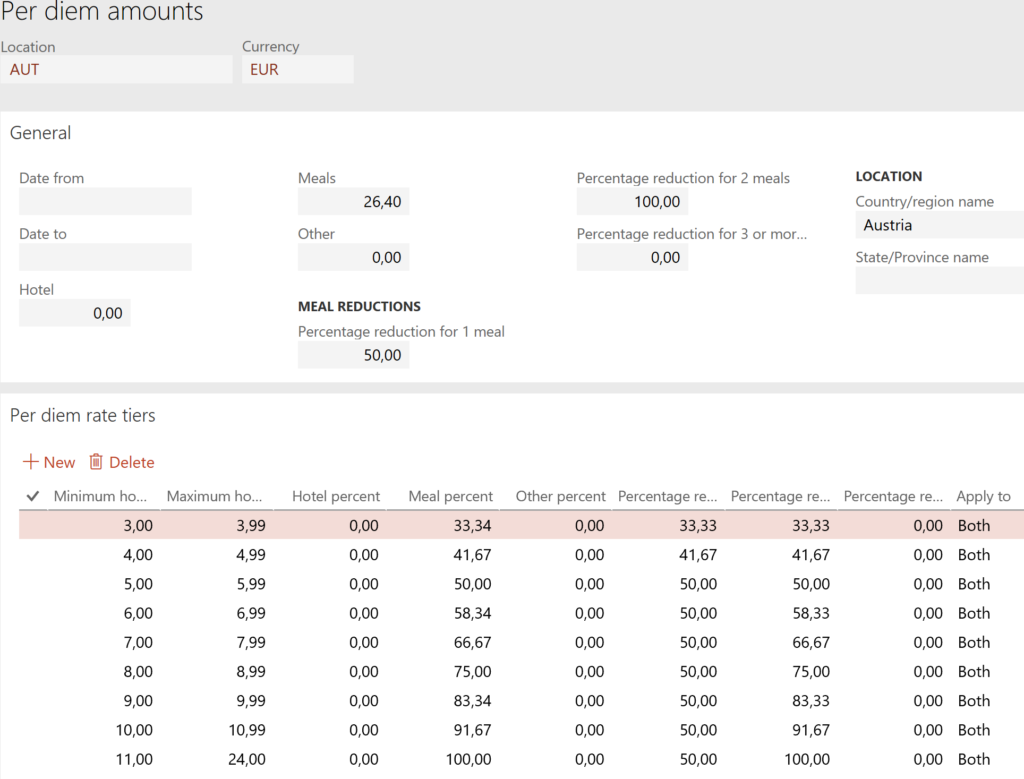

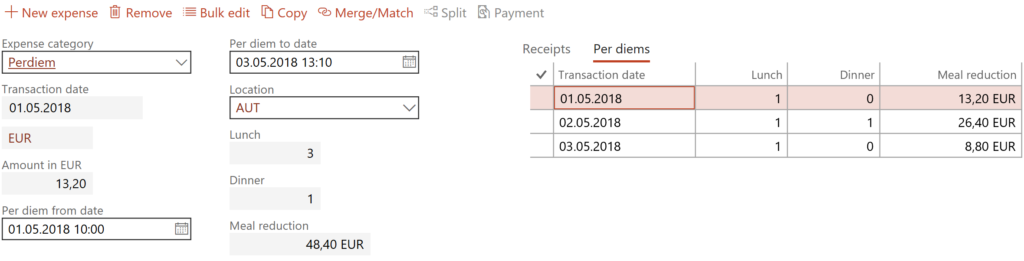

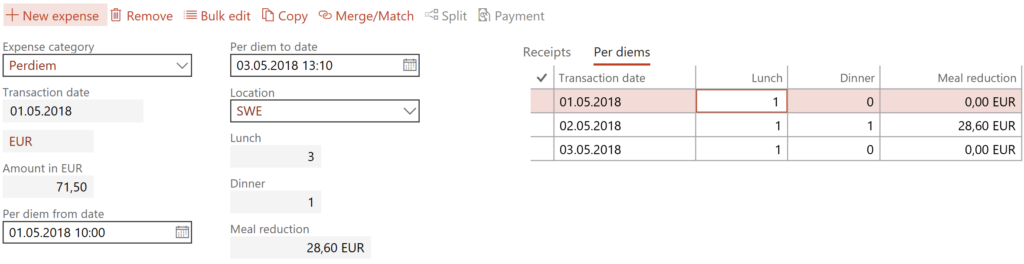

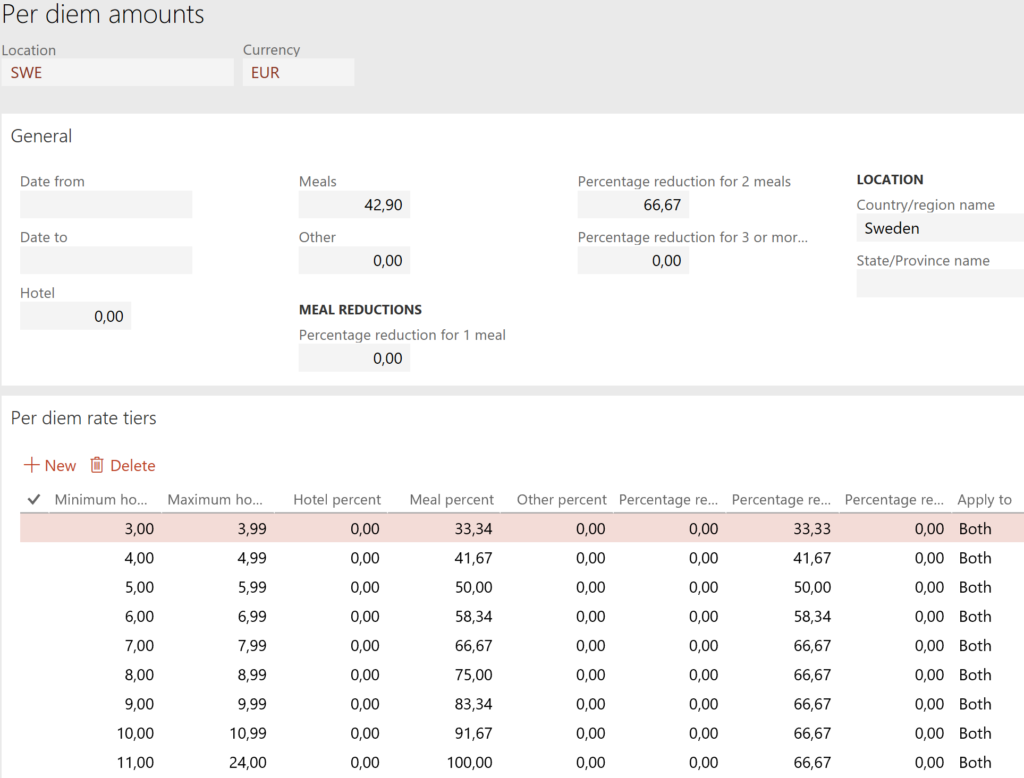

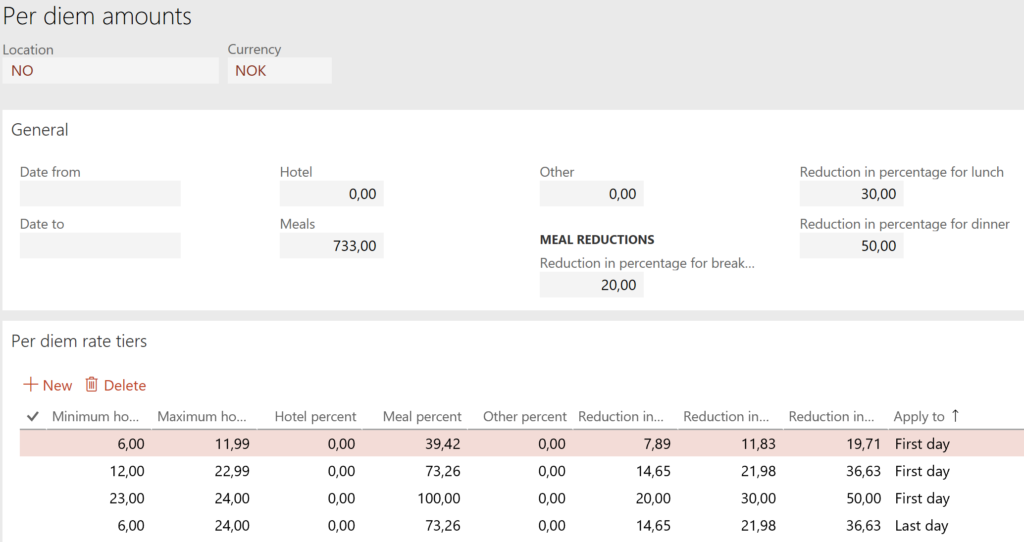

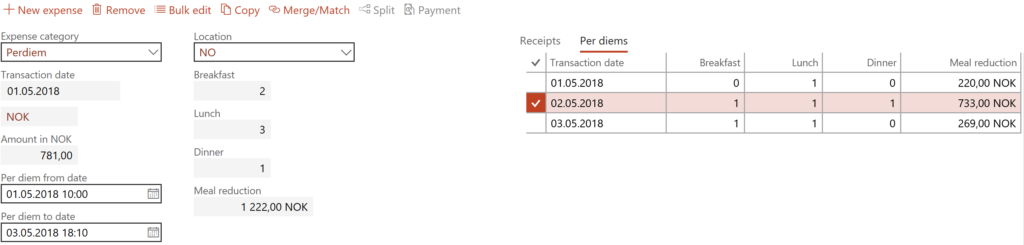

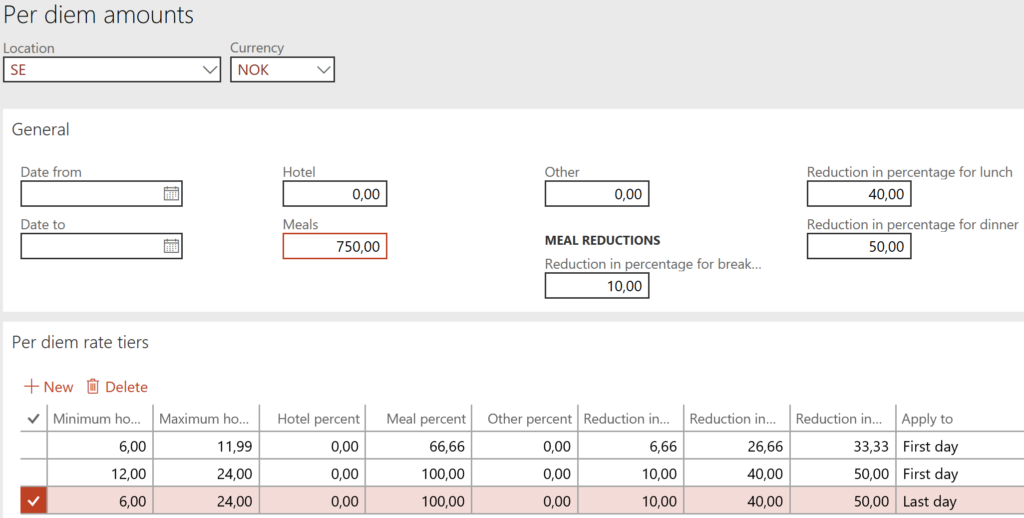

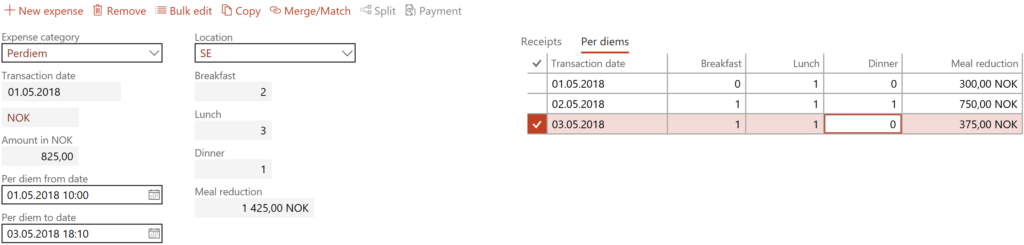

Configuring Austrian and Norwegian per diems in Dynamics 365