Introduction

Engineering and construction projects are mostly offered at a fixed price and almost every time require a down payment from the client. In Dynamics 365 for Finance, this is reflected by a Fixed-price project. Payments are represented by On-account transactions, also called payment Milestones. By the Austrian, German tax law there is a difference between:

- Down payments or Advance payment invoices (de: Anzahlungsrechnungen): they are charged by the service provider against an obligation to provide a future service. Upon the receipt of the payment to the bank account there is no income in the sense of the corporate tax, yet a VAT obligation (VAT-on-payment or IST-Besteuerung (de)). An invoiced advance payment debits the Accounts receivable and may credit the account “Advance payments invoiced” (de: “Verrechnete Anzahlungen”), while a received prepayment becomes a liability (de: “Erhaltene Anzahlungen”).

- Partial and final invoices (de: Teilrechnungen, Schlussrechnungen, see Anzahlungs-, Teil- und Schlussrechnungen (wolf-partner.at)) are issued upon the delivery of goods and materials and/or services and subject to VAT “on invoice”. A turnover is generated, and (at least in Germany and Austria) the profit is recognized. The partial and final invoices offset (reverse) the advance payments. In construction, this is even a different type of the VAT: reverse charge vs. full VAT on prepayments.

Our accountants wish to book the advance payment invoice in the Balance sheet (liability) and the partial or final invoice in the Profit & Loss section (turnover). For a Time & material project, this is trivial: the true revenues come from billed hours, expenses, materials, while the advance payments – and advance payments only – are represented by on-account transactions with the type “Prepayment voucher” and “Deduction”.

Yet in the case of a Fixed fee project, there is no difference between down, partial and final payments in standard Dynamics 365: everything is a milestone with a certain amount. To divert the project milestones to different accounts, we’ve seen sub-projects opened only for cause of the advance payment invoicing. We believe, there is a much better, straightforward solution: to mark the Advance payment milestone with a special VAT Group. This is especially practical in the case of huge amounts and long payment terms where we also wish to apply the delayed VAT on payment mode and activate the “French” Conditional VAT.

Setup example

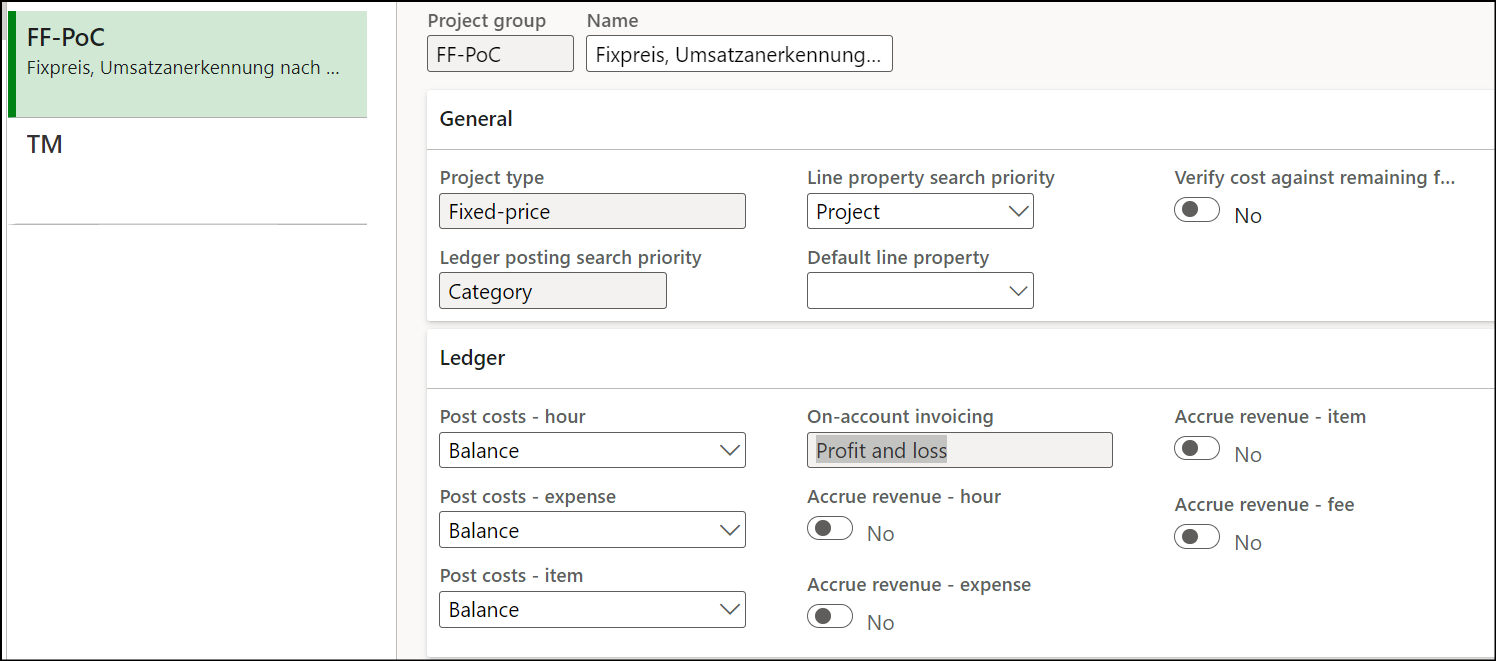

In the DEMF legal entity of the “Contoso” demo database, we create a Fixed fee project group project where the on-account transactions are posted into the Profit and loss:

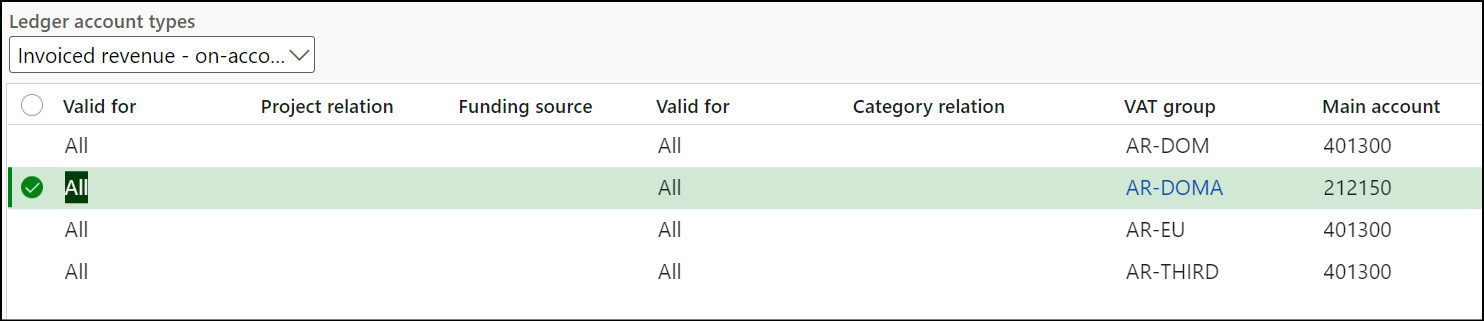

This applies to the normal -partial and final invoices. To divert the advance payment milestone to a balance account, in Project management and accounting > Setup > Ledger posting setup we configure the Invoice revenue – on-account posting by VAT group and introduce at least one new special debtor VAT group for advance payments: AR-DOMA. This way of aligning the revenue accounts with the VAT is very common in European D365 implementations, you see it in every product posting setup:

A milestone with the group AR-DOMA is posted here against a liability (main account 212150).

Now, if – for a total order volume of €100.000,00 – we agreed upon the 10%-40%-50% payment schedule with the customer, then the on-account transaction should look like this, at a first glance:

Yet with the 2nd milestone cannot directly offset the liability. To debit this account 212150, we have to introduce a negative advance payment milestone, increase the partial invoice milestone by the same amount with the intent to bill them together: 40% – 10% = 30%.

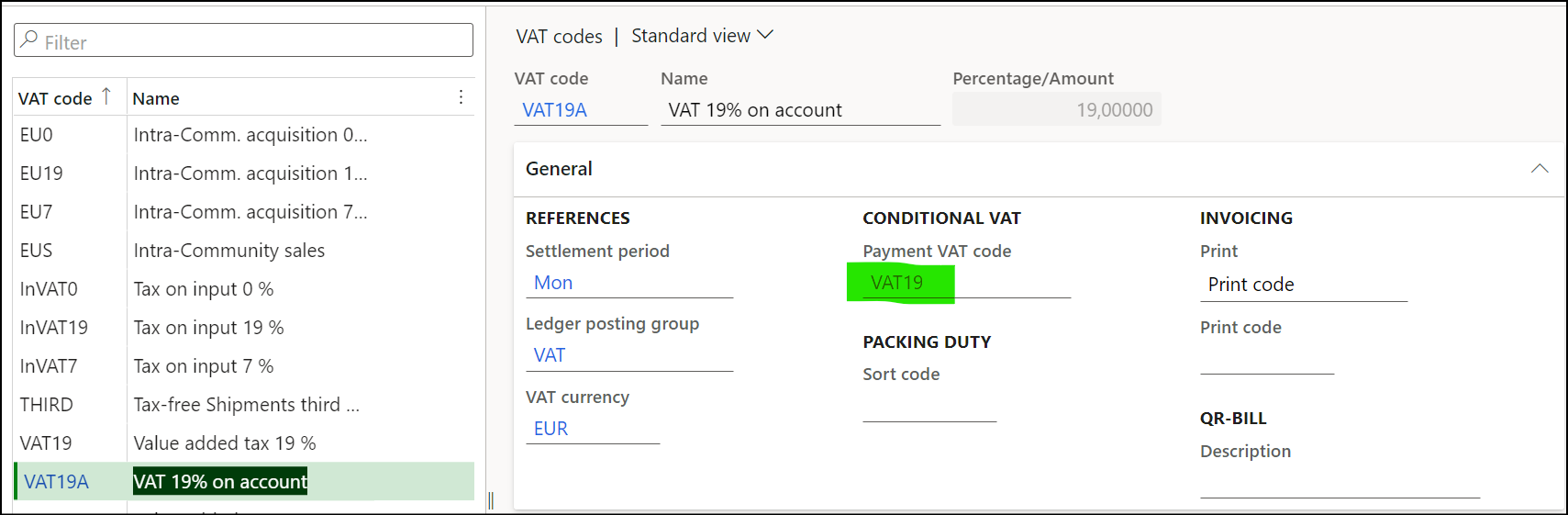

To round this up, we activate the Conditional VAT general ledger parameter and give the AR-DOMA group a special VAT code VAT19A, there the VAT19A relays the tax liability to the regular Payment VAT code = VAT19 upon the settlement of the future project advance invoice with the customer payment:

The Settlement period may be a special one, not reported to the German tax authority, and the account VAT paid may be the same as 212150: we calculate the prepayment VAT, we show it on the invoice to let out customer refund it, but we don’t have to pay it right away .

The “anti-prepayment” milestone should actually contain a yet another VAT group, because we are crediting account 212150, but the VAT code should the regular one, because we are going to reverse a paid advance payment invoice with the VAT already paid.

Create an invoice proposal with the advance payment milestone, then try to post it. A highly unpleasant surprize awaits: “Discrepancy between account 68719604503 and setup of the group for invoicing Profit and loss” (de: Projektvertragskennung: …Unstimmigkeit zwischen Konto und Einstellung der Gruppe für die Rechnungsstellung ‘Gewinn und Verlust’). The enigmatic number here is the RecID of the main account 212150. An overzealous developer implemented in the class ProjPostOnAccProposal.checkAccount() a validation of the main account type (BS vs. P&L) against the project group setting, they never expected a project invoice posted into the Balance sheet today, and into the Profit and loss statement tomorrow.

To inhibit this check, implement a one-liner in X++, an extension

[ExtensionOf(classStr(ProjPostOnAccProposal))]

final class ProjPostOnAccProposal_Extension

{

protected boolean performMainAccountCheck()

{

next performMainAccountCheck();

return false;

}

}

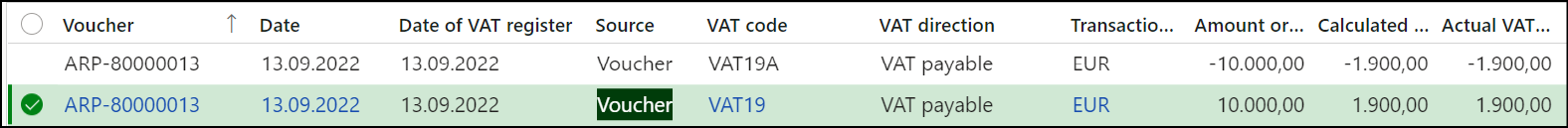

Now the advance invoice can be posted. The posted VAT code is VAT19A. Settle the advance payment invoice with the customer payment, and the Related voucher shows the re-allocation of the VAT liability from VAT19A to VAT19:

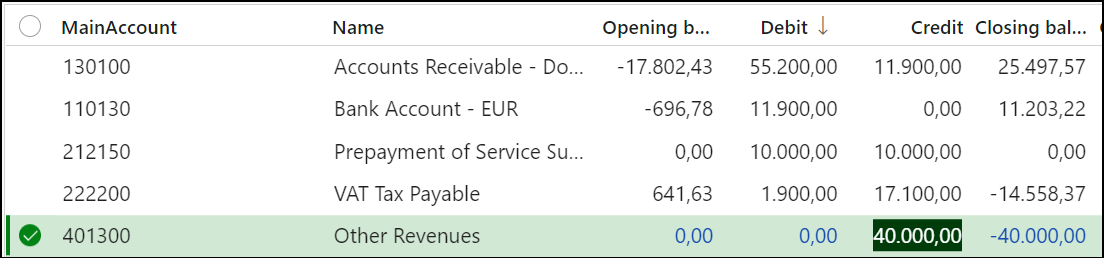

Now post the second (partial) invoice with the 2nd and the 3rd milestones together and behold the main account turnovers and balances after: they are right how they should be:

By the way, should we introduce an interim account “Advance payments invoiced”, the transfer between the accounts “Advance payments invoiced” à “Advance payments received” cannot be performed by the automatic routines of the Project management and accounting module. This has to happen manually triggered by the settlement of the advance payment invoice. The accountant may also monitor the movements on the VAT19A code which happen upon the settlement. The “anti-prepayment” milestone should offset the final account “Advance payments received”, then.

Project Management and Accounting blog series

Further reading:

Dynamics 365: Migrating fixed price projects and WIP balances

Advance payment invoices in Fixed fee projects in D365, D-A-CH style

What Item requirements can’t do

Revenue recognition with project budget shadow forecasts

Intercompany project invoicing in practice: Process

Intercompany project invoicing in practice: Setup