Z4-Meldung an Bundesbank in D365 for Finance

The Z4-Meldung “Zahlungen im Außenwirtschaftsverkehr (abbreviated “AWV”) is a financial report that German companies must submit to the Deutsche Bundesbank as part of their external sector statistics. Companies are usually required to submit this report on a monthly basis, depending on the volume of transactions.

All German companies that engage in cross-border financial activities (e.g., loans, deposits, securities transactions) with a value above a specific threshold (currently €50000 per transaction) are required to submit this report. The worst part of it: not only transactions with non-EU countries must be reported, but inbound and outbound payments to EU countries as well. This is a nightmare in the tightly integrated EU economy.

Luckily, payments related to trade in goods (such as exports or imports) are not reported in the Z4-Meldung. These transactions are typically covered under other reporting mechanisms, such as the Intrastat for trade within the EU. Instead, the Z4-Meldung focuses on financial transactions unrelated to the direct exchange of goods e.g., loans, financial investments, and – most importantly – services. In particular, these transactions may be:

- payments for services rendered for a foreign entity or paid to a foreign supplier,

- for instance, freight costs

- bank interests paid or received

- cash discounts given to foreign customers or received from foreign suppliers

- rebates received or paid

- intercompany recharge to or from a foreign HQ or a subsidiary

- VAT payments to a different EU tax authority.

The Z4 report has a simple XML structure following their proprietary “XMW” schema: XMW – Elektronisches Meldewesen im XML-Format. In the regular payment process, in- and outpayments are classified with a transaction type (BELEGART) of “1” or “2”, respectively. In every transaction the foreign country is listed (ISO2), along with the transaction description and the amount in tsd. Euros. The sub-type classifier “KENNZAHL” poses a significant challenge: there are ~1000 codes in total from “A” for airfare through “S” for services till “U” for the use of software. This list from hell is published here in an inconvenient Excel file: “Kennzahlenliste mit Belegarten”.

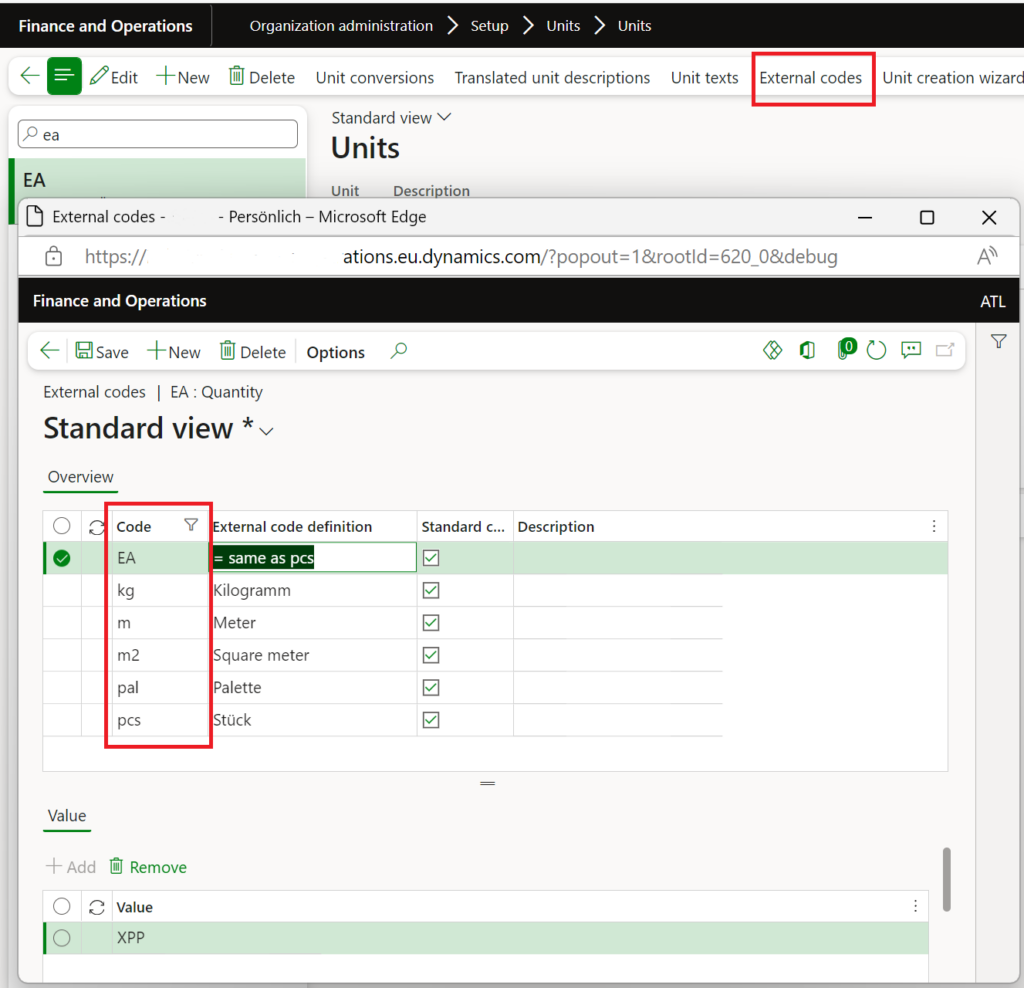

We are happy to share an Electronic Reporting configuration for the Z4 report in Dynamics 365 for Finance. Only the regular payment transactions (“DIKAPPOSTEN”) are supported, not shares or similar capital investments. To segregate payments by the highly detailed “KENNZAHL“, we suggest using the voucher prefix. For example, you may need to introduce different GL journal names for salary payments and commissions payments, both with distinct voucher number sequences. To avoid mistakes, we recommend separate payment methods, especially for goods and services, with every payment method to be processed in its own AP/AR payment journal.

Setup and use

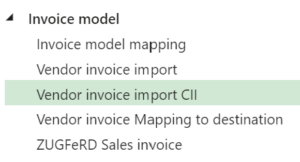

- Download the 3 configurations here: XMW Deutsche Bundesbank model v3.zip

- Install them in the following order: XMW Deutsche Bundesbank model -> XMW Mapping -> Z4 (format). Beware: the configurations are provided to you “AS IS” and with all faults and defects without warranty of any kind.

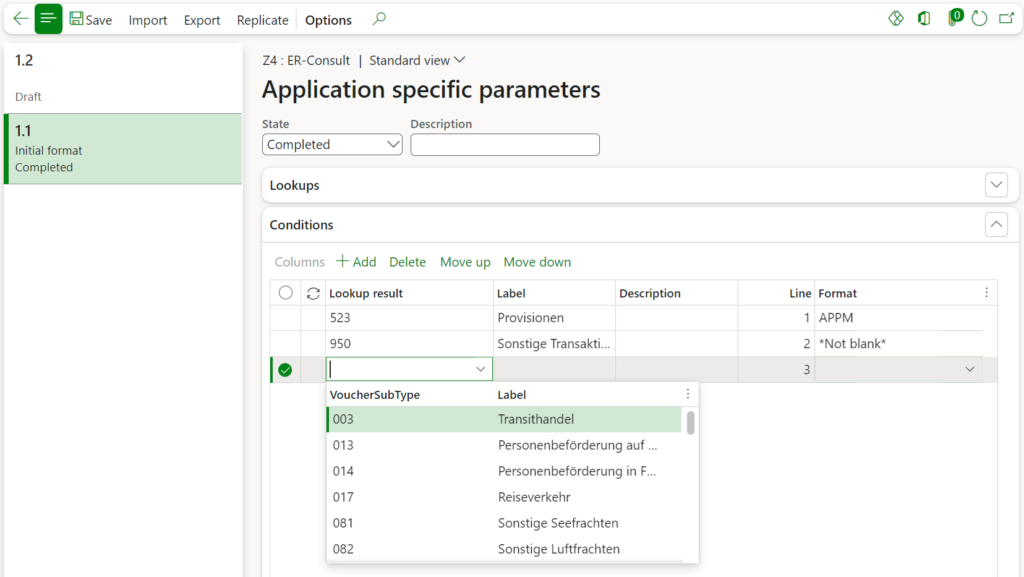

- Select the Z4 configuration and open Application specific parameters / Setup. You may Import a rudimentary setup here: Parameters 26-09-2024 09.43.13 pm_Z4.8.3.zip

- With this setup you match patterns in the voucher of the bank transaction to the “KENNZAHL” codes. In some cases, you may decide to start looking for keywords in the payment description instead. This will require a slight modification of the formula in

model/Messages/Message/Transactions/$ClassifierEnum. Alternatively, you may start probing for vendors or introduce a special vendor group with regards to the Z4 reporting; this is going to require a minor adjustment in the mapping and the format. - Set the status of the application specific parameters to Completed when ready.

- Select the Z4 format in the Electronic reporting tree and hit Run.

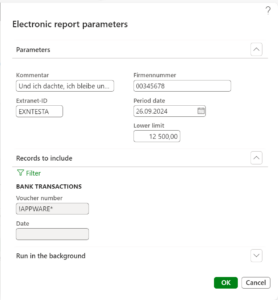

- The Firmennummer is the unique end-to-end ID issued by the Bundesbank at the registration. You may also set the Extranet-ID of the user, if known. The mandatory phone, e-mail and other contact information are extracted from the employee card of the current user (the user who is executing the report i.e. you).

- With the Period date you select the reporting period (month). An empty period date means the rolling current [session] month. Try to exclude bank transactions with regards to the trade of goods with the filter of Records to include, for example by the voucher number, if possible. You may also consider opening a different bank account for the regular intracommunity business. Again, try to separate payments of service, commissions etc. with distinct journals = voucher number.

- Hit OK and execute the report.

- You may also run the report in an unattended, batch mode. Configure an Electronic reporting destination such as an internal e-mail address or a SharePoint folder, schedule a monthly batch and keep the period date empty to support the rolling date. You can monitor the batch runs in Organisation administration > Electronic reporting > Electronic reporting archived jobs.

Result

The resulting file may look like this:

<LIEFERUNG-AWZEL xmlns="http://www.bundesbank.de/xmw/2003-01-01" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.bundesbank.de/xmw/2003-01-01 BbkXmwAwzel.xsd" version="1.0" erstellzeit="2024-09-27T08:30:33+02:00" stufe="Produktion" bereich="Statistik" dateireferenz="1">

<ABSENDER>

<FIRMENNR>00345678</FIRMENNR>

<NAME>ER-Consult GmbH</NAME>

<STRASSE>Franz Lehar-Gasse 18</STRASSE>

<PLZ>7111</PLZ>

<ORT>Parndorf</ORT>

<LAND>AT</LAND>

<KONTAKT>

<ANREDE>Miss</ANREDE>

<VORNAME>Julia</VORNAME>

<ZUNAME>Funderburk</ZUNAME>

<ABTEILUNG>Sales & Marketing</ABTEILUNG>

<TELEFON>425-555-5053</TELEFON>

<EMAIL>julia@contoso.com</EMAIL>

<EXTRANET-ID>EXNTESTA</EXTRANET-ID>

</KONTAKT>

</ABSENDER>

<KOMMENTAR>Und ich dachte, ich bleibe unter dem Radar...</KOMMENTAR>

<MELDUNG erstellzeit="2024-09-27T08:30:34+02:00">

<MELDEPFLICHTIGER>

<FIRMENNR>00345678</FIRMENNR>

<NAME>ER-Consult GmbH</NAME>

<STRASSE>Franz Lehar-Gasse 18</STRASSE>

<PLZ>7111</PLZ>

<ORT>Parndorf</ORT>

<LAND>AT</LAND>

<KONTAKT>

<ANREDE>Miss</ANREDE>

<VORNAME>Julia</VORNAME>

<ZUNAME>Funderburk</ZUNAME>

<ABTEILUNG>Sales & Marketing</ABTEILUNG>

<TELEFON>425-555-5053</TELEFON>

<EMAIL>julia@contoso.com</EMAIL>

<EXTRANET-ID>EXNTESTA</EXTRANET-ID>

</KONTAKT>

</MELDEPFLICHTIGER>

<MELDETERMIN>2024-09</MELDETERMIN>

<VDR_04>

<DIKAPPOSTEN belegart="2" kennzahl="523" zahlungszweck="Provision 2024">

<BETRAG land="CN" landname="China" betragsref="APPM000063">-18</BETRAG>

</DIKAPPOSTEN>

</VDR_04>

</MELDUNG>

</LIEFERUNG-AWZEL>

Electronic reporting blog series

Further reading:

Customer invoice falsifier for D365 for Finance

Amend GDPdU = GoBD = FEC

Z4-Meldung an Bundesbank

Enumerate lines in Configurable Business Documents

D365 Electronic Reporting: JOIN records in pairs

Electronic Reporting (ER) Cookbook 4: References in a model

Electronic reporting for data migration

Electronic Reporting (ER) Cookbook 3: Working with dates

Electronic Reporting (ER) Cookbook 2: new tips from the kitchen

Electronic Reporting (ER) Cookbook