Luxembourg VAT Declaration for D365FO in PDF

There is the 2nd most prosperous country on this planet, which is apparently too small to get a proper VAT declaration in Dynamics 365 for Finance. Not too small for ER-Consult, though.

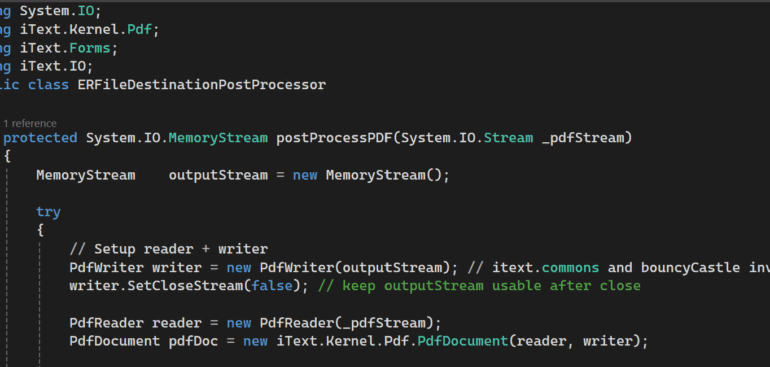

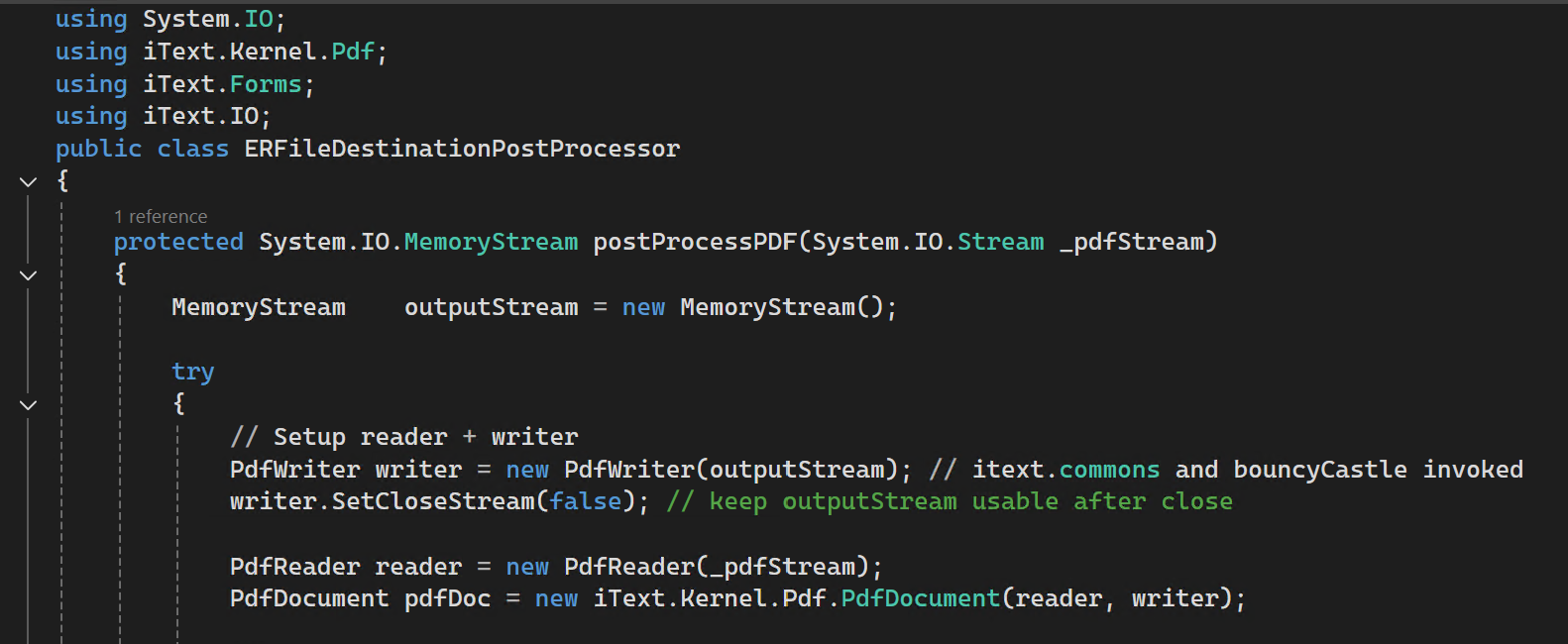

We are releasing a complete Luxembourg VAT Declaration (TVA) built entirely with Electronic Reporting and delivered as an AED-compliant PDF form. All relevant boxes of the declaration will be populated, including the sales regime, the key turnover fields, reverse-charge sections for both EU sales and EU purchases, the deductible VAT areas, adjustments, and all totals required for the final VAT balance, as well as the identification header.

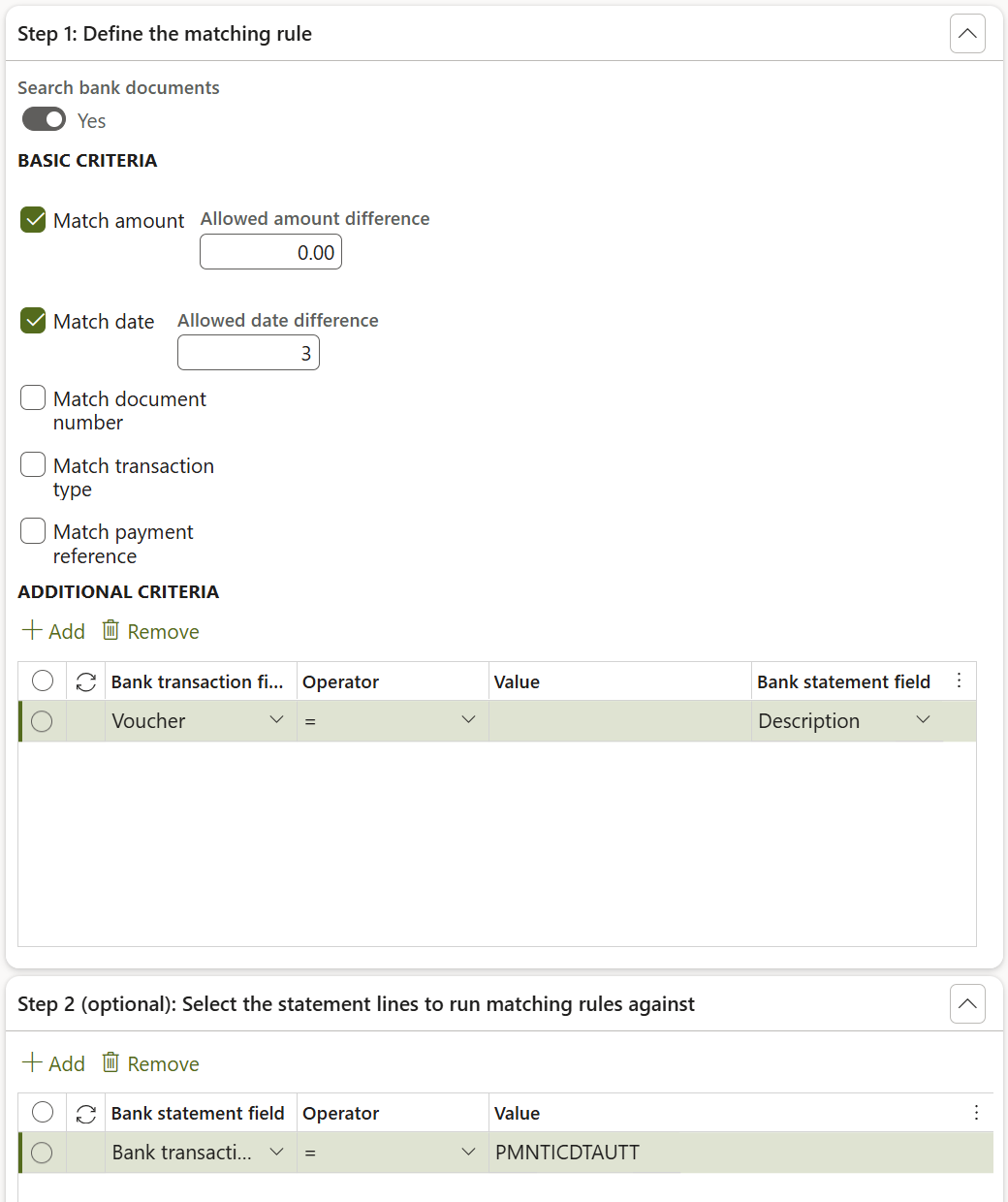

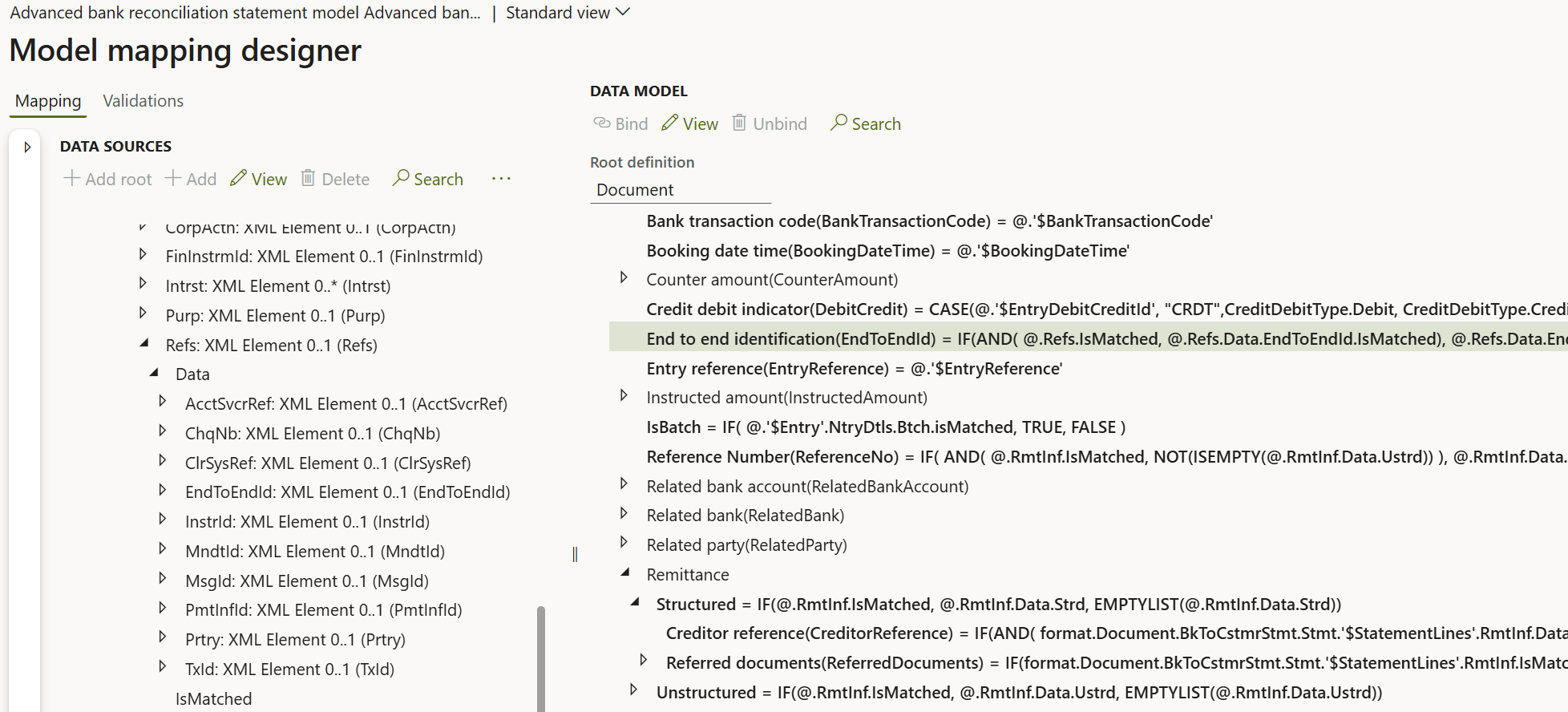

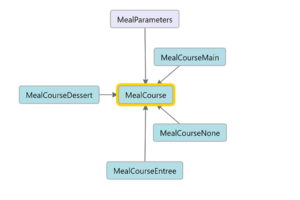

A tax code lookup, implemented exactly like in all other supported VAT declarations in Dynamics 365 for Finance, ensures that the mapping between VAT codes and declaration boxes is fully configurable and free of hard-coding. This makes the solution transparent, maintainable, and aligned with Microsoft’s Globalisation framework.

Blog series on Finance and VAT in the EU

Further reading:

Luxembourg VAT Declaration for D365FO in PDF

Troubleshoot the VAT Declaration in D365 for Finance

D365 Petty cash review

Advance payment invoices in Fixed fee projects in D365, D-A-CH style

Sometimes you pay Reverse Charge in D365

Minimalistic EU VAT Configuration in Dynamics 365

Austrian VAT declaration / Umsatzsteuervoranmeldung 2020

EU Tax directives